Responsible corporate citizen or conniving oligopolist? I’ll plop for the former for now, despite the inherent conflict of interest in the CEO of the country’s largest bank pleading “over-competition” in the domestic banking sector. Why? Because I think he’s right as far as non-bank lending is concerned, and because if the remark came from outside the banking community it would have been accepted without reservation (excerpt):

‘Rein in super-easy personal loans’

KUALA LUMPUR: Maybank wants the authorities to tighten control on the ease with which personal loans are being given out to consumers.

CEO Datuk Seri Abdul Wahid Omar cited personal loans given out either by non-bank entities or “over-competitive” banks, as worrying.

“We need stronger enforcement from the authorities on the personal loans issue as it is becoming a cause for concern,” he said after the group's annual general meeting.

Wahid suggested that non-bank lenders were quite lax when giving out personal loans, saying that these institutions should look at adopting some of the same standards as banks, especially when underwriting the loans.

“Those involved should not simply disburse personal loans based solely on salary deductions to attract customers,” he said.

He also expressed concern that there was “over-competition” in Malaysia's banking sector, with banks being aggressive in pricing their loans to attract customers.

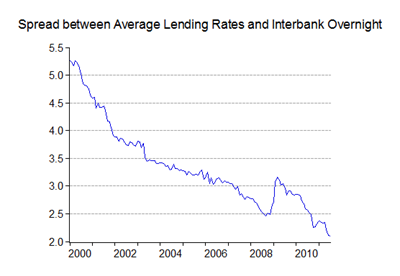

Lending by DFIs and cooperatives is the real worry here. I’m not so sure about competition between banks – as long as lending guidelines are maintained, that’s far less of a worry. The biggest problem the banks face is margin compression as despite low cost of funds, lending rates aren’t terribly high either:

Based on research, the banks will need an approximate 3% gross interest spread to survive a “normal” business cycle recession. Right now it’s too low, which would tend to substantiate Wahid’s concerns – but it’s not that far off. And looking at the trend, this is a long term structural issue, not something that came up overnight or just after the recession. The likeliest explanation is foreign capital inflows and trade receipts, which adds considerable liquidity (and fragility) to the interbank market. The August figures should be out later this afternoon, so we’ll see what the latest situation is soon.

Yes, but these DFIs and non-bank institutions have a higher COFs since they don't fall under BAFIA. A bit rich for Wahid to cry foul.

ReplyDeleteIf he wants stricter controls on them, let's have a level playing field and give them avenues to lower their COFs

Not sure what you're talking about here Rodger - his reference to competition is within the banking sector, not with the non-banks.

ReplyDeleteThe problem with the DFIs and cooperatives isn't their competition per se, but their credit standards - or rather almost complete lack of them. You might have noticed around town: blacklisted/bankrupts welcome etc.

weird that its coming from maybank. they are the only bank who keeps sending me those cheques for RM10k and RM20k each month to spend.

ReplyDelete