From last Saturday’s Star (excerpt):

…Over the last one to two years, the increase in Malaysia's household debt has been largely fuelled by the availability of cheap mortgage rates arising from the cut-throat competition in the housing loan market.

Cheap money has enticed people to borrow and the rate of which households are taking on debt to buy houses, cars or finance renovations or holidays has indeed grown.

Since the 2008 global financial crisis, Malaysia's household debt service ratio, which measures the ratio of debt payments to disposable personal income, has jumped about 10 percentage points to 49% in 2009 before easing slightly to 47.8% last year…

…Given where household debt as a percentage of GDP is and the earning power of families, concerns are mounting that the country's growing household borrowing activities could possibly make the local financial sector and economy more vulnerable to external economic risks, especially now with the ongoing debt crisis in the eurozone and the lacklustre growth trend in the United States…

…Given that 84% of current household debt emanates from the banking system and that lending to households remain strong, growing at 12.8% in the first seven months of this year, it would be prudent to slow down lending, he says

The remaining RM92bil or 16% of total household debt not owing to the banking system can be attributed to loans from employers, money lenders and cooperatives.

The bulk of cooperatives lending to members are accounted for by civil servants and, given the job security in the public sector, the credit risk for cooperatives would remain manageable, says Yeah…

…Another banking analyst points out that although household debt level in Malaysia is high, locals have a relatively high savings rate, at about 35% of GDP.

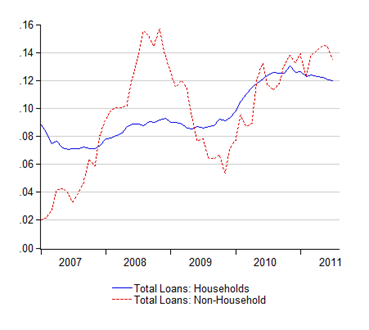

First, let’s put this in context…for most of the past three years, household borrowing from the banking sector has lagged corporate borrowing by a fair margin:

Add in corporate bond issuance, and the comparison’s even more in favour of business borrowing. So the slant taken in the article, focusing as it does purely on the household sector when borrowing there has been slowing for the past year, smacks of beating a dead horse.

To be fair though, I do have a problem in that there are no good statistics detailing total household borrowing: the graph above only show those extended by the banking system. Yet even then, I’m not unduly concerned about the banking system’s household exposure here.

The rest of the borrowing, as the article states, is mostly from other sources. And unlike the article, this is the part that worries me more. You might want to read snowball’s series of posts on MBSB for a detailed viewing of this potential time-bomb. I’m not sure if Bank Rakyat or BSN are any better – the track record of the development finance institutions (DFIs) in general over the years doesn’t inspire confidence.

While I’ve no doubt civil servants do indeed enjoy enviable “job security”, that doesn’t exempt them from foolishly overextending themselves on debt. And while I’m also sure neither borrower nor lender is going to take a loss, somebody will be picking up the tab if it blows up – the taxpayer.

It’s notable that BNM has expressed their concerns over the credit quality of the DFIs as it relates to household lending in the latest Financial Stability Report and Payment Systems Report (link here, read pg16 ). But since none of these institutions fall within BNM’s regulatory purview, I’m not sure what they can do apart from moral suasion.

One last point: that last paragraph I quoted from the article above is completely misleading. While it’s true that Malaysia has a high national savings rate, this is not the same thing as a high household savings rate (most of it in fact is corporate savings, not household savings). Nor should it be mistaken for household wealth – comparing a stock variable (level of debt) against a flow variable (the rate of savings) is a good approach for misdiagnosis. The aggregate figure also hides what I suspect is considerable heterogeneity in the level and rate of savings between different income groups.

So while I’m perfectly sanguine about the systemic risk to the banking system posed by the current level of household debt, I’m fairly certain that there’s potential for a whole lot of pain for certain segments of society and those lending institutions outside the banking system (and thus not subject to the discipline that entails). Not on the scale of Korea’s credit card disaster ten years ago, but enough to be worrisome.

You are absolutely correct about getting real statistics detailing household debt.

ReplyDeleteItems that don't appear as personal debt (until actual legal recovery) would include all unpaid..... rent, maintenance fees, unpaid services (IWK, phone, electricity), quit rent and assessments etc. These are still debt.

In your last paragraph, what do you mean by "those lending institutions outside the banking system (and thus not subject to the discipline that entails)"?

ReplyDeleteThe DFI's are exempt from complying with the Banking and Financial Institutions Act (BAFIA), and don't have to meet Basel guidelines on capital adequacy. Nor are they required to conform to the standard credit evaluation practices of the banking industry. Given the size of the exposure (nearly 10% of all outstanding loans), this is an obvious point of weakness for stability in the Malaysian financial system.

ReplyDeleteBank Rakyat for instance falls under the ambit of the Ministry of Entrepreneurship and Cooperative Development, not BNM, and BSN is governed by an Act of Parliament. The other DFIs are similar.

I know BNM is frustrated with the situation, as they've had to clean up the mess at some of the DFIs over the years.

Thanks for clarifying. I can see how BNM is frustrated. Their mandate is to manage the monetary system to ensure stability in support of the government's aspirations.

ReplyDeleteYou can only manage what you know. Problem with the DFI is since they are outside BNM - no need BAFIA, Basel, etc. Does anyone really know the true financial conditions of the DFIs in terms of capital adequacy, loan growth and % leverage etc? Are the loan portfolio marked to market or marked to fantasy? Surely BNM does not have the full picture either.

Yes this will be a point of weakness.

Hi Hisham, I noticed that BNM publishes the loans given by the banks to the household sector. However, I can't seem to find data related to the household loans given by the DFIs and Insurance companies. As these institutions come under the purview of Negara, shouldn't there be the data available? Thanks!

ReplyDelete@anon 6.56

DeleteLoans to anybody by the insurance sector are so small, its not worth counting. In any case, BNM has a whole section in the latest MSB devoted to insurance, which will give you the totals.

DFIs only came under direct regulatory purview of BNM beginning in July this year, so you might see the detailed data beginning next year.

Hi Hisham.Thanks a lot for the clarification. Yes I am quite interested to see how much the DFIs are lending to the household sector since this figure has been increasing steadily. I did read this Maybank report which managed to show the data for DFI household loans. The source is BNM but it isn't in the MSB. Would you know where it comes from?

Deletehttp://research.maybank-ib.com/pdf/document/Banking_SU_20130712_MIB_4606.pdf

(Page 3)

@anon,

DeleteAnnual data is available through the Financial Stability and Payment Systems report:

http://www.bnm.gov.my/files/publication/fsps/en/2012/zcp07_table_A.01.pdf

Good luck trying to reconstruct the time series though, because the format and presentation of the data changes every year.

Ah I see. Odd how they don't put it in a nice Excel format under the MSB. Anyway, thanks a bunch!

Delete@anon

DeleteIt's not in the MSB because the data is fragmentary and in annual frequency only. Not really worth putting into an MSB table.