The Department of Statistics last week issued Malaysia’s IIP report for 2009, which shows the level of Malaysian ownership of foreign assets matched against foreign ownership of Malaysian-domiciled assets. If you want a simpler business-type analogy, the balance of payments is our external cash flow report while the IIP is our external balance sheet report.

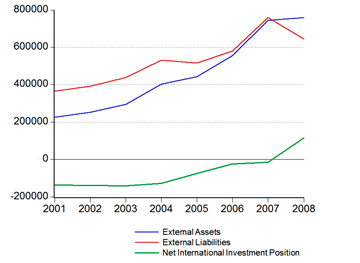

I’ve noted before that Malaysia has become a net creditor nation in 2008 – we own more foreign assets than foreigners own our assets – and for the first time since independence. The 2009 data more than confirms this trend (RM millions):

Now whether this is good or bad depends on your point of view. The rapid increase in foreign asset accumulation in the last 5-6 years has largely been driven by direct investment (and reinvestment of earnings) abroad by Malaysian companies (RM millions):

…compared with relative stability in foreign accumulation of Malaysian assets (RM millions):

The problem here is that Malaysian companies are investing abroad corporate savings that might have been invested domestically – one reason why private investment growth has been so poor since the 1997-98 crisis, and why we have not been able to match the growth rates in GDP that we saw pre-1997. The outflow of funds (we’re talking about half a trillion Ringgit over the last ten years) has also played a role in dampening appreciation of the Ringgit.

The flip side of this is of course, that our income account in the balance of payments is going to improve over time as investments (hopefully) bear fruit – a source of foreign exchange which will be non-trade related, and thus reduce our external vulnerability.

One further side effect of this is that it reduces the incentive for massive accumulation of foreign exchange as an insurance policy against capital outflows, which can be expensive. Luckily, BNM has more or less ceased forex intervention (with some notable exceptions) since the float of the Ringgit in 2005, but there are still structural factors which will inhibit reducing our reserves over the short run – liquidity of foreign portfolio assets for starters, as well as the relatively higher proportion of foreign ownership of Malaysian equities and debt.

But this development does mean that one of the underpinnings of the Ringgit’s valuation is long term positive.

Technical Notes:

- 2009 International Investment Position from the Department of Statistics

- Lane, Philip R. & Milesi-Ferretti, Gian Maria, “The External Wealth of Nations Mark II: Revised and Extended Estimates of Foreign Assets and Liabilities, 1970-2004”, International Monetary Fund Working Paper 06/69, March 2006

No comments:

Post a Comment