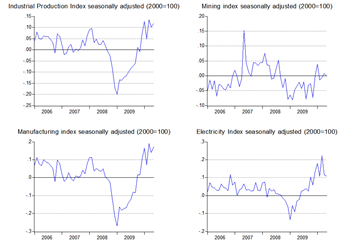

So much for the expectations that GDP growth will slow in the second quarter. Export growth numbers weren’t very encouraging, but it appears domestic production has more than offset slowing external demand (log annual and monthly changes; seasonally adjusted; 2000=100):

Both mining and electricity production were flat in May relative to April, but manufacturing output has ticked up (for now). But growth is certainly not coming from the export-oriented subsectors like electronics (log annual and monthly changes; seasonally adjusted; 2000=100):

I’ve also checked the relationship between IPI and exports (single-equation, VAR etc) and while it’s possible to forecast exports and IPI through lags of each variable, it’s an iffy proposition – lots of statistical problems like serial correlation and heteroscedasticity. A cointegration test reveals no long term relationship between the two variables, and Granger causality tests turned up negative. In short, exports are not a good guide for values of IPI nor vice versa, and any regression based on these two variables will be spurious.

So, what does the IPI imply for 2Q 2010 GDP? No cointegration problem here, so there is a long term relationship, although causality tests are negative. So it’s possible to forecast GDP using IPI values, as long as you recognise that we’re not talking about an increase in IPI “causing” GDP to rise, and you don’t mind using a forecasting regression rather than a full-featured, theoretically-correct structural model. Also bear in mind that we’re only looking here at two month’s worth of IPI numbers (April-May) for the second quarter, so June IPI numbers may materially change the forecast.

With those caveats in mind, I got a point forecast of RM139.5 billion and a range forecast at the 95% level of RM142.2-136.8 billion, which imply a y-o-y annual growth rate of 9.6% (range: 11.8%-7.5%), and a q-o-q seasonally adjusted annualised growth rate of 8.9%. The former implies a slight slowdown over 1Q 2010, while the latter suggests economic growth accelerated instead:

Technical Notes:

No comments:

Post a Comment