From the comments:

Wenger J Khairy said...

Dear HishamH,

Appreciate your response. Perhaps would like to comment further on the link between reserves and the BOP. The argument was presented in the book the "Dollar Crisis".

The author presented the case for the link between reserve build up and a growth in the money supply. He cited Thailand and Japan and as the example.

The thrust of the story

(a) From strict correlation point of view, reserve and credit growth was correlated for the case of Japan, Malaysia and Thailand. The lag maybe between 1-2 years.

(b) Build up of reserves act as high powered money entering into the domestic banking system.

(c) One can draw a simple flow chart how lets say surplus US dollars earned by Sime Darby gets deposited as Ringgit in Maybank, and at the same time increases Bank Negara reserves.

In the case of Thailand, their reserve build up was due to surplus on the Capital and Financial account

(d) Build up of reserves act as exogenous source of credit creation in the domestic banking system. If there was a build up of credit due to solely endogenous factors, wouldn't it be highly inflationary?

My wife told me that I’m barely comprehensible to readers who aren’t that knowledgeable about the inner workings of economics or finance, so I’m going to answer Wenger’s query in some detail – though this post will feature a little bit of double-entry accounting.

Wenger’s arguing that increasing future domestic credit (i.e. loans to businesses and individuals) which is necessary to drive economic growth, requires a build-up of international reserves and points to some evidence that this was the channel for loan growth in Malaysia in the past.

I don’t think this is true under the present circumstances, but to see how and why we have to go back to two things – how Bank Negara manages the Ringgit exchange rate, and the money creation process itself (i.e. the supply of money) which can lead to an increase in loanable funds in the banking system.

“Sherman, set the Wayback machine”. We’ll have to go back in time to early 2005, when the Ringgit was pegged to the US dollar at the exchange rate of RM3.8 to USD1. To use Wenger’s example, let’s say Sime Darby wants to remit USD1 million back to Malaysia from profits made in their overseas operations (*cough* obviously not from Qatar *cough*). So this money gets deposited in Sime’s account with Maybank, and Maybank duly credits Sime’s account with USD1 million and debits their own cash account with USD1 million.

Now at this stage, the money supply has increased by an equivalent of USD1 million, but with only limited impact on credit creation. Maybank can in practice lend on the USD1 million its carrying on its books to another customer, but because Sime can call on that USD amount at any time, the bank wouldn’t be really eager to do so in case they got caught short of USD. And unless Sime has some other US dollar denominated liability to pay off or wants to invest the money somewhere, it won’t be eager to keep the US dollars it has in its account either – Sime can’t use it to pay its Malaysian shareholders, workers or suppliers with that money, since its not legal tender in Malaysia.

So to make both sides happy, they exchange currencies – Sime buys RM3.8 million from Maybank in exchange for the USD1 million it has in its account (I’m ignoring transactions costs in all of this). Sime’s account now has RM3.8 million, and Maybank is down by RM3.8 million cash, but the USD1 million they have is now unencumbered and they can lend it to anyone they like without worrying about an offsetting deposit. The problem Maybank have is that whoever takes on that USD loan is also taking on exchange risk, and USD loans are of limited use in Malaysia because its not legal tender – so there aren’t going to be many takers*.

*I can’t remember the rules right now, but IIRC among local banking institutions, only Labuan-based companies have the legal right to offer foreign currency loans to Malaysians and Malaysian companies. Deposits are of course another matter.

But this is where Bank Negara comes in. Since Malaysia was committed to a peg of the Ringgit to the USD at RM3.8 (we’re still in 2005 remember), BNM aren’t happy at the transaction between Sime and Maybank, because it puts upward pressure on the Ringgit exchange rate. So what they do is they sell RM3.8 million to Maybank in exchange for the USD1 million, thereby putting downward pressure on the exchange rate and preserving it at RM3.8.

Assuming BNM has the cash on hand then the accounting entries are fairly simple - BNM credits its “cash” account (asset) with RM3.8 million, and debits its “international reserves” account (asset) by USD1 million. If they don’t then BNM can create it literally out of thin air – crediting their “currency in circulation” account (liability), and debiting “cash” (asset). The newly created “cash” is then used to buy USD from Maybank, so Maybank loses the USD from its cash account but gains RM3.8 million instead.

To make a long story short, Sime’s action in bringing USD1 million results in an increase in the domestic money supply by RM3.8 million, because Maybank now has an extra RM3.8 million not owed to anyone (the “high-powered” money), to lend out to its customers.

The above narrative demonstrates the channel through which surpluses in the current account and financial account of the balance of payments are cycled through the banking sector to create higher money supply growth. The fact that foreign exchange reserves also increased is just a consequence of having a fixed exchange rate.

In practice of course its rarely as clear cut as I’ve outlined, as BNM has sometimes tried to sterilise money inflows like this through the issuance of BNM bills (which aren’t loanable) against excess cash (which is) in the banking system. Nor do the amounts traded always match exactly, as it depended on how much Ringgit BNM needed to inject into the system to maintain the Ringgit exchange rate.

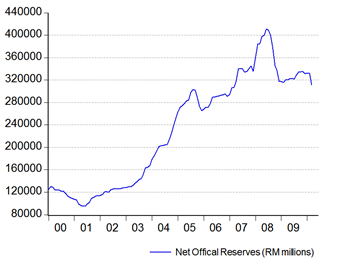

But to get back to the bone of contention, this story just doesn’t apply anymore. The Ringgit was floated in July 2005, and Bank Negara has hardly intervened in the exchange rate markets since, with two notable exceptions – the commodity bubble of 2007-2008 which prompted BNM to try and slow the pace of exchange rate appreciation (accompanied by full sterilisation measures); and the emergency situation in late 2008 right after the Lehman Brothers bankruptcy, when BNM had to step in to supply USD to a banking system desperately short of it.

So in terms of the flow I’ve outlined above, the story under a floating rate regime basically stops with Maybank holding USD1 million in cash unencumbered, and Sime with RM3.8 million – there is an increase in the domestic money supply, but without BNM exchange rate intervention there’s limited impact on the supply of loanable funds.

Apart from the episodes of intervention I’ve outlined, international reserves should be more or less static, except where the banking system is too long or too short in foreign exchange assets. In fact, what you ought to see is banking system net holdings of foreign currency assets moving in tandem with current account and financial account surpluses or deficits, instead of international reserves. To wit:

In other words, the relationship between money supply and loan demand on one side, and international reserves on the other, largely breaks down after the Ringgit was floated. The change in exchange rate regime was highly significant – theoretically in an open economy under a floating exchange rate regime (assuming rational actors and efficient markets), you don’t need international reserves at all. That world of course doesn’t really exist, so we need some reserves on hand to manage foreign exchange liquidity in the presence of massive and highly volatile capital flows. But apart from that, international reserves no longer serve any other function.

Hi HishamH,

ReplyDeleteThanks for the lengthy explanation. I really appreciate how you explained the process on a) fixed exchange rate regime and b) the floating rate regime. I have to re-read b) a couple of times.

Its always good to have a discussion with yourself as I learn a lot more.

Warm Regards

For the benefit of unschooled pedestrians like me, is this good or bad news.

ReplyDeleteRoofer

Roofer, it's neither. What I'm arguing here is that under a different policy regime, you have to look at different indicators.

ReplyDeleteUnder the current regime we're following in Malaysia, the level and growth of international reserves no longer indicate anything at all.

In other words, it's not good news or bad news, instead it's non-news.