And they’re sorta right, though I wouldn’t put too much credence in the idea of a “weak correlation”. Correlations have a way of reversing just when you least expect them to, and when you can least afford it. To turn that old chestnut on its head, the absence of correlation does not necessarily imply a lack of causality. Correlations are also highly sensitive to the sample you choose – relying on them isn’t a great idea:

Malaysian Stocks Offer Foreigners ‘Safe Refuge,’ JPMorgan Says

July 28 (Bloomberg) -- Malaysia’s stock market is a “safe refuge” for foreign investors seeking shelter from volatility in other Asian markets because of its domestic economy and defensive qualities, JPMorgan Chase & Co said…

…The Malaysian market has “defensive characteristics such as low volatility and weak correlation with major indexes,” he said. “The market is back on a high; we see evidence of foreign monies trickling in based on foreign incremental buying and ownership levels.”

Foreign ownership in Malaysia’s market rose to 20.6 percent at the end of June from 20.3 percent in February, signaling a pickup in net buying by foreigners, Oh said.

I’m going to cover what JPMC is talking about, and why the basis they’re using might be problematical.

First the correlations. The chart below shows the monthly correlation coefficients for the KLCI against the Dow Jones Industrials, FTSE100 and Nikkei 225, with a sample range of Jan 2008 to June 2010:

The correlations are highly volatile, but the fact is, you can’t exactly describe them as “weak”. Full sample correlations are 0.76, 0.86 and 0.66 respectively – you can only make an argument for the Nikkei, but not the others. And Jakarta and Shanghai are marginally better (i.e. weaker correlations against those indexes) for this sample period. The point is, correlations or lack thereof are a poor indicator of relative risk and the potential to diversify portfolios. In a crisis, asset prices will tend to converge (read: crash) together.

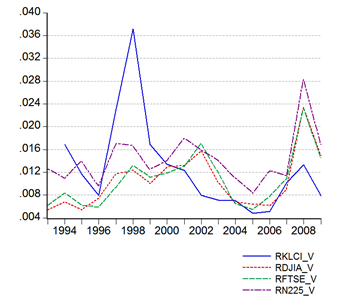

The volatility argument is on more solid ground (I’m defining volatility here as the standard deviation around daily price changes in log terms). Since the end of the 1997-98 crisis, the KLCI has consistently had the lowest or one of the lowest volatility measurements among the major indexes, both globally and in the region (major markets: top; regional indexes: bottom):

If you safety is what you're looking for, i.e. predictable yields on capital gains and dividends, then the KLCI should be on your radar.

But there’s an inherent paradox here – an influx of foreign funds into Malaysia would negate the very reason why the KLCI has been so staid and boring in the first place. To wit: the relative lack of foreign investor participation over the last decade. Higher foreign portfolio inflows into KLCI stocks would cause the very increase in volatility that investors are running away from.

It’s a funny old world, innit?

But there’s an inherent paradox here – an influx of foreign funds into Malaysia would negate the very reason why the KLCI has been so staid and boring in the first place. To wit: the relative lack of foreign investor participation over the last decade. Higher foreign portfolio inflows into KLCI stocks would cause the very increase in volatility that investors are running away from.

ReplyDeleteHit the nail right on the head.