Having just watched Brazil crash out of the World Cup, I’m in need of some cheering up (all kudos to the Dutch for persevering though). Not that there’s much to cheer about in terms of government finances. 2Q numbers aren’t in yet, and won’t be for another couple of months, but the numbers don’t look terribly encouraging (RM billions):

On the other hand, the Treasury hasn’t been all that aggressive in borrowing over the last three months, largely going to market only to rollover maturing debt. As a result, outstanding Government debt has barely budged from 1Q 2010, at approximately RM378.4 billion.

Instead, most of the action has been in the money market with BNM issuing a startling net RM37 billion in bills in April and May (typically for 3-6 month maturities) to keep the interbank money on track with the OPR. But since BNM’s open market transactions are financed (or paid off) by the issuing of currency, it doesn’t count towards the government’s debt level.

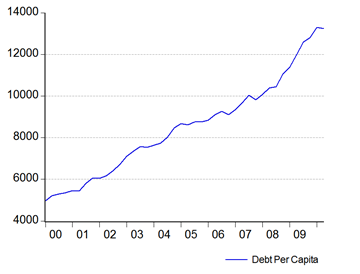

In any case, with the population increasing by approximately 150,000 every quarter, and as nominal GDP has increased in 1Q 2010, the national debt ratios have levelled off:

Estimated debt to GDP now stands at approximately 53.6% as of last month, which puts Malaysia below the 60% alarm-bells-are-ringing level, while debt per capita retreated slightly to RM13,227 from RM13,292 in 1Q. I’m actually expecting government revenue to show slightly positive growth this year, as against the government’s projection of an 8.1% drop – which means that they’ll probably hit below the 2010 target of 5.6% of GDP easily (the increase in revenue will be offset by an off budget increase in expenditure, but I’m also expecting 2010 GDP to surprise on the upside).

So from my perspective, we’ll probably see some improvement on the debt front this year, but with growth prospects increasingly uncertain, I’m not putting any bets on 2011-2012.

No comments:

Post a Comment