I’ve been playing single parent this past week while my wife is overseas, hence the late commentary on Bank Negara’s first monetary policy statement for the year. Not that there’s much to comment on, given the relative boringness of current monetary conditions (excerpt):

Monetary Policy Statement

At the Monetary Policy Committee (MPC) meeting today, Bank Negara Malaysia decided to maintain the Overnight Policy Rate (OPR) at 3.00 percent.

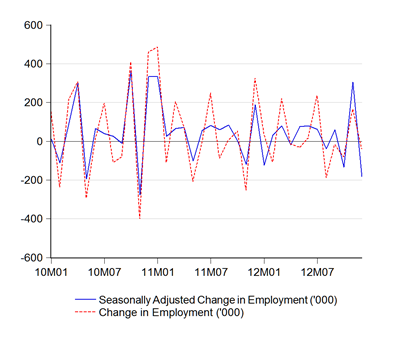

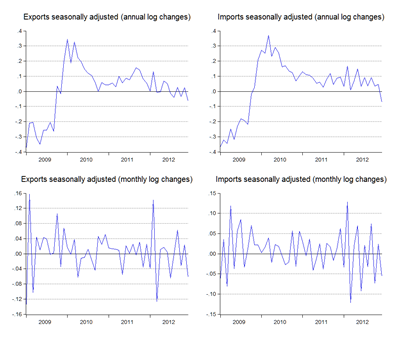

The global economic activity is showing signs of improvement, albeit at an uneven pace. Growth in the major advanced economies remains constrained by ongoing fiscal consolidation and weak labour market conditions. In Asia, growth is supported by sustained domestic demand and a gradual recovery in external demand. Stress in the international financial markets has also receded. Notwithstanding these improvements, downside risks to the prospects for global growth still remain.

In the domestic economy, a broad set of indicators suggests robust expansion in the fourth quarter of 2012...Looking ahead, domestic demand is expected to continue to expand, underpinned by firm private sector activity...while investment will be led by capital spending in the domestic-oriented sectors, the oil and gas industry and the on-going implementation of infrastructure projects...

...In 2013, inflation is expected to be higher but to remain modest. Selected global food prices and domestic factors are expected to increase costs and contribute to higher prices. Nevertheless, given modest global growth prospects, pressures from global commodity prices is expected to be contained.

I don’t see any potential move any time in this first half of the year, and I hardly think anybody else thinks so either. The second half might be different – given the wave of infrastructure and property projects coming into play this year, we might be dealing with accelerating inflation in the second half, and certainly a deteriorating current account.

But looking more than six months ahead has always been a bit dicey, though I’d be more comfortable if we had longer gaps between major investment projects.

I’m reminded in this case of what happened in the mid-to-late 1990s, when Malaysia had a number of mega-projects taking off all at once. That had positive feedback loops into the economy, and Malaysia’s property sector ended up overheating, with you-know-what effects. I’m not seeing the same thing this time, mainly because the Ringgit isn’t overvalued as it was back then. But this is still something to be concerned about – and to watch for – in the months to come.