This actually came out last week, but I’ve been too bum lazy to touch on it. But the results, as preliminary as they are, yield some pretty interesting information – and not just for the population numbers:

Thursday, December 30, 2010

Tuesday, December 28, 2010

Department of “Duh”: Corruption Not Good For Growth

Believe it or not, the empirical evidence on the effect of corruption on economic growth isn't clear. The same can also be said for democracy and democratic institutions. In a new article on VoxEU, Campos and Dimova review the literature (excerpts):

Corruption does sand the wheels of growth

Does corruption sand or grease the wheels of economic growth? This column reviews recent research that uses meta-analysis techniques to try to provide more concrete answers to this old-age question. From a unique, comprehensive data base of 460 estimates of the impact of corruption on growth from 41 studies, the main conclusion that emerges is that there is little support for the “greasing the wheels” hypothesis…

Monday, December 27, 2010

The Dark Side Of Gold

Bloomberg/Businessweek has been running a series of articles over the past couple of weeks looking at the human costs of gold’s popularity. They’ve now brought together these articles and some associated graphics and videos on a single portal.

I’m not going to comment on this, but worth a look if you’re interested in the gold market.

Thursday, December 23, 2010

Measuring Inflation Revisited

A little over six months ago, there was quite a bit of debate on the adequacy of Malaysia’s inflation measures (see here and here). For many people, the official estimates of inflation didn’t seem to jive with their on-the-street experiences. I contended (and still believe) that its partly a perception issue, partly a factor of slow income growth (relative to inflation and productivity) and partly a problem of income inequality.

But before going further, what prompted this post was an article in Slate (excerpts):

Do We Need Google To Measure Inflation?

…Each month, the Bureau of Labor Statistics goes through all that hassle because knowing the rate of inflation is such an important measure of economic health—and it's important to the government's own budget…

But just because the government expends so much energy determining the rate of inflation does not mean it is tallying it in the smartest or most accurate way. The reigning methodology is, well, clunky…[and] archaic, given that we live in the Internet age. Prices are easily available online and a lot of shopping happens on the Web rather than in stores.

November 2010 CPI

After last month’s “exciting” little excursion due to the hike in tobacco excise duty, things have settled down on the inflation front. Even with that, increases in the price level have steadied at just under an annualised 2.0% since the middle of the year (log annual and monthly changes):

Wednesday, December 22, 2010

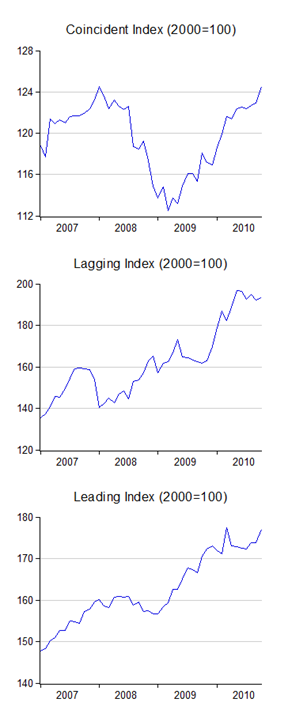

October 2010 Economic Indicators

No question that things are looking up. Today’s economic indicators report from the Department of Statistics underscores the argument that 3Q 2010 was at worse a pause in growth:

October 2010 Employment Report

After the pause in 3Q 2010, it looks as if the Malaysian economy is accelerating again. So much for labour supply constraints…employment has hit an all time high in absolute terms (‘000):

The Typology Of Capital Controls

Menzie Chinn at Econbrowser sends us to the World Economic Forum’s Financial Development Report 2010, which has a nice broad summary of capital control tools and their strengths and weaknesses. I won’t reproduce the graphic (that’s a breach of netiquette), so head on over to Econbrowser if you’re interested in the subject.

Worth a glance, since capital controls are the flavour of the day, and likely to remain so for some while.

3Q 2010 Government Revenue and Expenditure

Well, I’m back from my break, and catching up on events. In the meantime I’ll be getting rid of the backlog of posts that I’ve been meaning to do.

First up is 3Q numbers on the Federal Government’s expenditure and revenue. As intimated by the 3Q GDP numbers, there’s been further consolidation in government spending (sample: 2000:1 to 2010:3):

Friday, December 10, 2010

Oct 2010 Industrial Production: Better Days

The report for this October’s industrial production indexes gives grounds for some optimism. You’re not going to see it from the annual growth percentages though (log annual changes; seasonally adjusted):

Thursday, December 9, 2010

Posting In December

I’ll be on leave and travelling for a couple of weeks, so posts this week and next will be pretty sporadic (as you’ve probably already noticed). There’s a few things that need covering – government 3Q numbers for example – but these posts will probably be late, and queued up, rather than real time.

I’m hoping to resume posting regularly after the 20th. In the meantime, Happy New Year to all Muslims.

Monday, December 6, 2010

Scott Sumner On Gold

This is the first commentary on the gold market that actually made sense to me:

...As far as I know there is really only one respectable argument that inflation expectations are approaching dangerous levels in the US. We know that 5 year TIPS spreads are low, and we know that the near to medium term consensus inflation forecast is low. We know actual inflation is low and falling. But then there are those gold prices.

I’ve never been convinced that the high gold prices were signaling US inflation fears…

...I seem to recall someone pointing out that Asian gold demand couldn’t be the problem, because the totals were fairly stable. But that confuses shifts in demand with movements along a demand curve. When world output is falling, it is necessarily true that total quantity demand will also fall. If you confuse demand and quantity demanded, it will never look like higher demand is pushing up prices when output is declining...

Sunday, December 5, 2010

New Economic Model Part 2

I haven’t had the time to read it yet (watch for an analysis later this week), but the NEM Part 2 Document was launched on Friday, and can be downloaded here.

Round 2 Subsidy Rationalisation

I almost missed this one (been out of town the whole day):

New subsidy cuts to save RM1.2bil

PUTRAJAYA: The prices of Ron95 and diesel have increased by 5sen per litre while liquefied petroleum gas (LPG) and sugar will go up by 5 sen per kg and 20sen per kg respectively.

Minister in the Prime Minister’s Department Datuk Seri Idris Jala said that the price hikes, effective midnight yesterday, were expected to result in a total savings of RM1.18bil.

He said the savings would be channelled towards the Government Transformation Programme including improving the urban transportation network, rural basic infrastructure and roads, education and efforts to combat crime.

Saturday, December 4, 2010

Oct 2010 External Trade

I expected a bounce, but not quite as good as this. October’s seasonally adjusted export numbers showed a monthly increase for the first time in six months (log annual and monthly changes; seasonally adjusted):

Friday, December 3, 2010

IMF: No Real Estate Bubbles In China and Hong Kong

Just a quickie note, for those who are interested. Two new IMF working papers investigate China’s and Hong Kong’s property markets. Their conclusion is that there are and will continue to be a structural and fundamental basis for the rapid price increases seen in both countries, though some parts of China’s high end property market appear overvalued (abstracts):

Are House Prices Rising Too Fast in China?

Ahuja, Ashvin, and Lillian Cheung, Han Gaofeng, Nathaniel John Porter, & Zhang WenlangSharp increase in house prices combined with the extraordinary Chinese lending growth during 2009 has led to concerns of an emerging real estate bubble. We find that, for China as a whole, the current levels of house prices do not seem significantly higher than would be justified by underlying fundamentals. However, there are signs of overvaluation in some cities’ mass-market and luxury segments. Unlike advanced economies before 2007-8, prices have tended to correct frequently in China. Given persistently low real interest rates, lack of alternative investment and mortgage-to-GDP trend, rapid property price growth in China has, and will continue to have, a structural driver.

Oct 2010 Monetary Conditions Update

Fascinating things going on in the monetary side of the economy, though you won’t know it from the money supply data (log annual and monthly changes; seasonally adjusted):

Thursday, December 2, 2010

Ranking Kuala Lumpur: Pre- and Post-Recession

Via the Economist’s Free Exchange blog, The Brookings Institution’s Global MetroMonitor tracks performance in major cities around the world:

In the current table of rankings(2009-2010), KL ranks 23rd out of 150, up from 37th during the recession period (2007-2009), but down from 17th before the recession (1993-2007).

Get the KL page here (warning: pdf link), or the full report here.

Just When You Thought You’d Seen Everything…

This is so funny, I had to share (click the pic for a larger version):

In case you’re wondering, that’s not the title page…that’s the whole paper! And read the reviewer’s comments at the bottom for an extra laugh!

[H/T Brad DeLong]

Wednesday, December 1, 2010

2009 State GDP

Just a quick note – I’m a little under the weather from a cold, so I’m taking it easy for the next few days.

This report was actually released last week, and almost brings us up to date on state level GDP. If you recall, DOS started releasing state GDP data about this time last year, starting with 2005-2006 data. The latest numbers report 2009 GDP figures by state.

I haven’t gone so far as to analyse any of the numbers (the October MSB release has priority), but there don’t appear to be too many surprises here – Penang was the worst hit by the recession, due to its high exposure to export manufacturing, while KL continued growing because of its high concentration of service industries.

Technical Notes:

GDP Report By State from the Department of Statistics