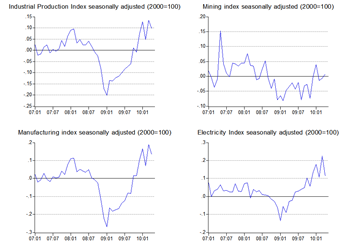

As April trade numbers have disappointed, so has industrial production (log annual and monthly changes; seasonally adjusted):

We’re going to see some revision in the consensus outlook for 2Q 2010 GDP growth based on these numbers, as its fairly clear that growth momentum is slowing. The Greek debt crisis in May will not help either, because part of the fallout has been a more rational valuation of commodities, fuel and non-fuel alike.

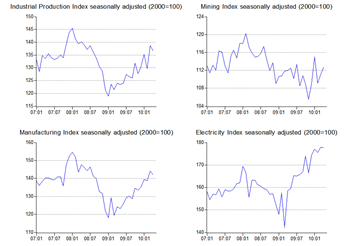

From examining the levels, it appears manufacturing is still in recovery mode, electricity generation is topping off (not a good sign for growth prospects), and mining is holding steady (2000=100; seasonally adjusted):

Most of the gains on the commodity-export front has been price-based, not volume-based, so the relative stagnation of mining output is not a worry.

On the other hand, it’s hard to tell where manufacturing is going because there is an overall surplus in capacity still (particularly in electronics), so external demand is the key factor here.

Electricity generation is partly consumer-based and partly industrial-based, so the slowdown here suggests the economic growth is also moderating, which was already evident in 1Q 2010. Much like in manufacturing, there’s a lot of surplus capacity in power generation (for the moment), so again this isn’t a supply constraint coming into play.

While I’d expect growth to pick up in May, I’m not holding my breath.

No comments:

Post a Comment