I’m still somewhat bemused that people ascribe all kinds of bad things things to the Fed’s quantitative easing. So far hyperinflation hasn’t happened, the dollar hasn’t collapsed, and civilization hasn’t come to an end. Once you actually look at the numbers, it’s pretty easy to understand why.

But first back to basics:

- In the modern financial system, money is created “endogenously” i.e. within the financial system itself, rather than by a central bank or via an external source (like in a gold-backed system).

- The primary mechanism is through loan/credit creation, where every loan granted involves the simultaneous creation of a deposit…in short, money.

- The same is not true of trading in financial assets within the system, as this involves the trading of a pre-existing asset (and corresponding liability).

- Central banks can influence the supply and “price” of money (the interest rate), by the purchase or sale of securities to the banking system, which involves the creation or destruction of money at the central bank itself. Loans from a central bank to any party involves the same money creation process.

- Note that the process of endogenously-created money also works in reverse – repayment or write-off of loans involves money destruction, a key differentiator with an exogenous money system, where money is almost never destroyed.

And here’s where some of the knee-jerk reactions to quantitative easing have got it wrong – people assume the classical case where money cannot be destroyed, but only added to. But there’s plenty of anecdotal evidence that US households and corporations are paying down debt – i.e. destroying money. The demise of Bear Sterns and Lehman, where they defaulted on much of their liabilities, also destroyed a few shiploads of money. The Fed’s actions in 2008-2009 really only just filled the gap – and little more.

The question I’m asking here is – what would be the level of the money supply in the absence of the Fed’s actions? Now, this is obviously more of a thought experiment rather than a serious attempt at quantifying the effects of the Fed’s crisis programs, because the response of the financial markets would differ and the Fed would have had to provide some liquidity assistance anyway in some shape or form. But it’s useful to be able to show what the impact might have been, if nothing had been done.

(For a survey on the impact on financial markets of the Fed’s original QE program and other measures, see Econbrowser)

But let’s turn to the actual numbers (USD billions; non-seasonally adjusted):

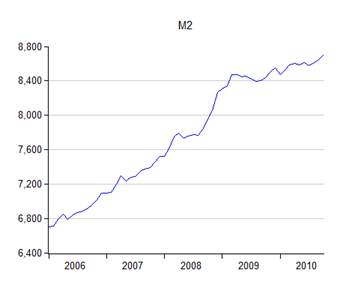

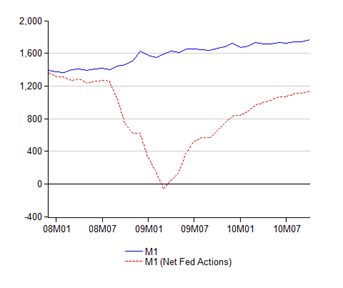

There’s a very obvious increase of about US$200 billion in M1 in 4Q 2008, and a bump in M2 of about three times that amount – so the Fed’s actions definitely increased the supply of money during the most critical periods of the crisis.

But here’s what I found most interesting about these numbers – they indicate an increase in money supply far, far, far less than the Fed actually pumped in.

Details of the Fed’s crisis era actions (and I mean detailed – names are named) are available here.

It’s a consultant’s goobledegook of acronyms, but the big ones are the Term Auction Facility (TAF) and Primary Dealer Credit Facility (PDCF) – both are essentially loan facilities granted on the basis of eligible collateral. Neither are in technical terms quantitative easing, and are more akin to ordinary central bank open market operations via the discount window, except for the scope of collateral accepted and the borrowers allowed to participate. However, since loans from the central bank involve money creation (see point 4 above), I’m including them in this exercise.

The actually QE part was under the Agency Mortgage Backed Securities Purchase Program (MBS), which involved direct purchases of Freddie Mac and Fannie Mae short term papers. I’m also inclined to include the three Maiden Lane special purpose vehicles used to take on the really toxic stuff from Bear Sterns and AIG, though technically these too involved loan facilities, not direct purchases (“printing money”).

There’s also a slew of smaller programs aimed at the commercial papers market, money market funds, CDO’s and other options, and the ongoing bailout of AIG – I won’t describe each one separately, as that’s a little too much for a blog post that’s getting overly long already. Suffice to say, almost all involve either purchases of securities or loans to financial market participants, and all would involve money creation at the Federal Reserve.

To deal with the MBS program first (US$ billions; non-seasonally adjusted):

The impact on M1 is big and obvious, while that on M2 is about 2%-3% – but as I said both are rather conjectural than anything else. In the absence of the MBS program and given the 0.25% Fed Funds Rate target, the Fed would have had to pump liquidity into the money markets irrespective of whether QE was used or not. The main difference was that QE provided a liquid market for MBS when there was practically none, and reduced market interest rates at the same time.

But let’s add in all the rest (I’ve only excluded here the central bank swap lines, which were non-domestic) (US$ billions):

The Fed’s crisis response peaked at about US$1.6 trillion in March 2009, the bulk of it (US$963.8 billion) under TAF. MBS purchases at that point stood at US$279.2 billion, CP purchases at US$245.6 billion, the Maiden Lane SPVs at US$71.9 billion, and a US$46 billion revolving credit line to AIG. Since then, the numbers have fallen – which if you followed my short refresher course above, you’d interpret as money being destroyed and a gradual tightening of monetary conditions.

The hypothetical money supply situation would stand as follows (US$ billions; non-seasonally adjusted):

Don’t need to spell these out, do I? Without the Fed’s quantitative easing and liquidity measures, base money in the banking system would have dried up completely. Approximately US$800 billion would have vanished in under 6 months through losses and defaults, a little over 10% of the total M2 supply.

But looking over the period as a whole, the idee fixe that the Fed’s money printing is causing a flood of liquidity and hot money into emerging markets is patently false – at best, the Fed has but maintained M2 growth on its medium term trend, if that:

A fifty year trend line shows the actual M2 path even further below trend than the chart above indicates. My own feeling is that what we’re seeing in terms of capital flows is more related to falling risk premiums and portfolio reallocation than anything else – stability and growth in emerging markets is attracting existing capital and liquidity stocks, not freshly minted ones.

But that also implies that these flows would reverse more quickly than they would under an excess liquidity scenario, since we’re talking about a more finite stock of capital than people expect. So watch for a reversal in the US dollar’s decline this year as US growth strengthens – and brace yourself when the Fed indicates it’s seriously thinking about raising interest rates.

I bet with you.

ReplyDelete1) Fed won't raise interest rate.

2) Dollar won't appreciate as per your analysis.

Teh tarik on me.

ReplyDelete1) I wasn't expecting US interest rates to rise this year - Taylor rule still indicates a negative target for the Fed Funds Rate. I'm not expecting a Fed move until early 2012 at the very earliest. But when it happens watch out - especially if you're in gold.

2. We'll see. And to be precise about what we're talking about, I'm refering to the broad nominal dollar index (Report H.10 from the Federal Reserve).

China's money supply growth has been in double digits for years, and inflation has breached 5% and is accelerating. India has had to raise interest rates today as inflation breached 8%. Inflation in Brazil has broken past 6%, Argentina 11%. Malaysia's monetary fundamentals still look solid, so the Ringgit I think will continue to rise.

The US? Money supply growth less than 3%, inflation below 1%, currency seriously oversold. Once people stare at these fundamentals long enough, they'll start realising where their money should be.

Hisham,

ReplyDeleteWhat are the serious debt situation of the US, measured by their Debt to GDP ratio etc as well as their budget deficit?

Basic economics textbook tells us that countries with high debt results in a weaker currency.

I am just wondering whether the weak US balance sheets will "offset" the possible appreciation of the US due to the rise in US interest rates.

Your views please.

Honestly, compared to other developed countries, the US doesn't look that bad. In fact, it looks pretty solid.

ReplyDeleteThe public debt to GDP ratio is expected to be around 60% in 2010, and peak at 62% this year according to the CBO's baseline scenario...and that's it.

The budget deficit really only affects yields on debt below three years maturity, so I tend to disregard it.

By comparison, Japan's ratio is at near 200% and they've been printing money like mad for twenty years - doesn't appear to have weakened the Yen any.

Most of the core European countries including Germany, the UK, and France also have higher debt loads than the US. Apart from China and Russia, most of the favoured emerging market currencies feature economies with similar debt loads to the US too. The more I look at the BRIC countries, the less I like - only China has solid fundamentals. Of the rest, only Indonesia looks like a sure bet, but inflation is getting out of hand there.

The "serious" debt problems of the US are really due to future potential unfunded liabilities (healthcare) and relative to their situation before the crisis. There's also the question of scale - in terms of quantum it's the biggest debt load in history.

But in relative terms it's not so bad. The recent research suggests that while investors start getting wary if debt-GDP breaches 60%, debt only starts hampering growth when it's over 90% of GDP.