I had a rather urgent assignment to finish last week, hence the relative paucity of posting – to be honest, last week was a bit mad and not to mention highly stressful. Shame I can’t really talk about much of it.

Anyways, April’s monetary conditions was always going to be overshadowed by the BNM’s OPR move in early May, so you can’t really read too much into the numbers, unless its to validate Monetary Policy Committee’s rationale for raising interest rates.

You might find some evidence from M2 growth (log annual and monthly changes; seasonally adjusted):

But this is a pretty weak foundation for starting another round of interest rate hikes – a one and done move won’t do much for BNM’s inflation-fighting credibility.

Instead, we’ll have to look elsewhere. MGS yields offer a clue:

After basically rising over the last few months, yields have unaccountably turned down – a signal of either an upturn in demand or falling supply. But if you’re thinking this is a sign of hot money coming in, like I initially did, you’d be wrong. The lower yields are a factor of reduced supply, as the government paid back a net RM8.2 billion in April (RM millions):

Gross redemptions in April actually hit RM19.7 billion, a record monthly figure, and higher than the total annual redemptions for all but six of the last 40 years. That much money going back into the system couldn’t have but helped to boost money supply growth – and so it might have, if BNM didn’t leech three quarters of it away at the same time:

This is but a taste of what’s to come, as the May increase in the OPR would also require open market operations to tighten liquidity.

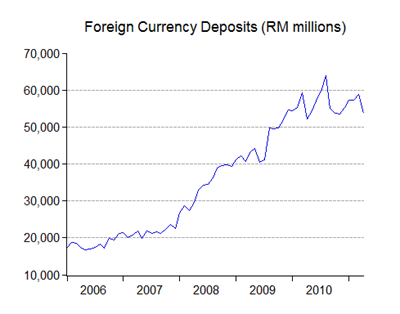

But the real story is of course foreign capital inflows. You won’t see it in the banking system (RM millions):

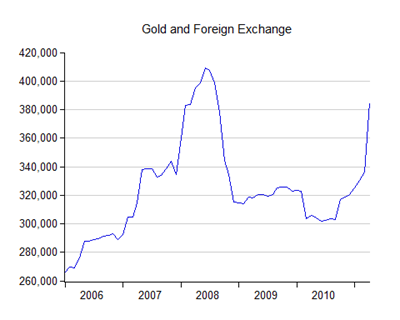

International reserves increased by a cool RM48 billion in April. The Governor claims this wasn’t due to forex intervention in favour of the USD – though I’m not sure how that’s possible unless there’s some central bank swaps happening in April (bro satD, your input would be greatly appreciated here). In any case, the evidence suggests that some kind of action was was going on (RM millions):

Forex turnover on the interbank market has doubled since February’s low. April’s RM220 billion in turnover is a monthly record by the way.

Bank’s aren’t letting all that money floating around go to their heads…yet (log annual and monthly changes):

Even as annual loan growth has climbed to over 12%, the monthly growth figure is on the low side for the range over the past two years. Banks are also opting to put some of the money aside in reserves at BNM (RM millions):

RM43 billion was added to the banking systems deposits at BNM, which is way, way more than required by the statutory reserve requirement.

So what does all this mean for monetary policy going forward? I continue to believe that we’ll see another hike in the OPR at the next meeting. The key question is less inflation, which is likely to continue rising both from high commodity prices and government cuts in subsidies, and more on the impact of capital flows on domestic monetary conditions.

There’s a limit to BNM’s ability to manage liquidity, as I pointed out before, but I think they’ll exhaust the potential of standard tools like the SRR and open market operations before resorting to any form of capital controls.

can't be the swaps bro, it would only be drawn when there is a serious short term needs for USD. The current trend is the reverse.

ReplyDeletethe reserve number indicates a higher position in Securities as well as Deposits with other CB's this is typical of inflows intervention especially if the position is parked in other CB's (short term with negligible market risk)...

That's what I thought - thanks!

ReplyDelete