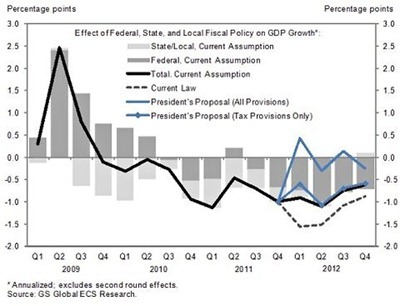

Via Ryan Avent and Paul Krugman, Goldman Sachs has a chart showing the impact of the US fiscal stimulus of 2008-2009:

Basically from the last quarter of 2009 onwards, fiscal policy acted as a brake to the economy, not as a boost. And monetary policy was not much better.

If you want a more wonkish look at this, there’s an interesting paper on NBER I pointed to last year. And Malaysia’s fiscal “stimulus” of the same period was not much more effective.

bad idea, stimulus. the only thing that all that cheap money did was to flood the emerging economies and fuel speculative bubbles in commodities and assets and drive up inflation. not a dime went to employing more workers, increasing bank loans to SMEs or building new infrastructure. classic dimwit solution - print money, cheh! How stupid can one get? better to drop the dead donkey than to prop it up with crutches. delaying the inevitable and at greater cost in the long run too. etc etc etc how can resources reallocate more efficiently with all this fake money swirling around?

ReplyDeleteMy friend, we're talking here about fiscal policy, not monetary policy.

ReplyDeleteSince in effect the "additional" spending was offset by fiscal consolidation in other parts of government (both here and in the US), then there's no extra money being issued or spent at the aggregate level. In effect, it's a transfer of spending from one part of government to another. The point of the graph above is that fiscal policy was actually contractionary for much of the last two years.

And even in monetary policy, I suspect that the "speculative" bubbles in emerging markets would have happened anyway. The ECB sterilised their QE program, and 2/3rds of the money "printed" by the Fed in 2009 for liquidity purposes was withdrawn within a year. Again, in QE2 for example, almost all the money the Fed "printed" stayed in the banking system's accounts with the Fed - none of it got out into the broader economy. Loan growth is bad in the US, not because the banks are refusing to lend but because borrowers are paying down debt and refusing to borrow.

So the only real explanation left for the capital inflows we've seen to emerging markets is really a search for yield using existing money balances only. Global inflation is being driven by money growth, not in the US, but in China and India.