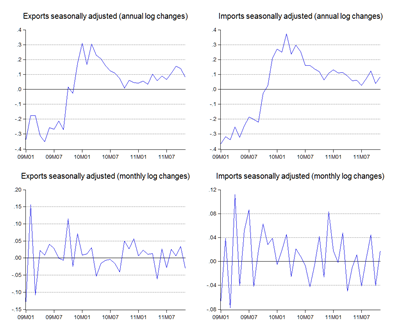

Mean reversion, here we come. As expected, November export numbers tripped up a bit (log annual and monthly changes; seasonally adjusted):

Even though annual growth exceeded 8.1%, it’s primarily due to lousy trade numbers last year and not because there’s any real growth here, as the levels make clear (RM millions):

In the larger scheme of things, it looks like Malaysia’s trade growth has really been on hold for the past year. Part of that was of course due to the natural disasters affecting the region, beginning with Japan’s tsunami in March and ending with Thailand’s massive floods in the last half of the year. Those disrupted supply chains in a variety of industries, from electronics to autos. It also makes looking at trade growth beyond a few months more than a little complicated – the flattish trade volume and slowing growth in Europe, China and India implies there’s little prospects for export growth in 2012, but those factors could be offset by a return to normalcy in production which could mean higher volumes.

But looking ahead we’ll probably see December numbers perk up a little in absolute terms (but with much worse growth numbers), judging by the higher import numbers for November (RM millions):

Seasonally adjusted model

Point forecast:RM57,004m (0.0% yoy, 0.0% mom)

Range forecast:RM64,157m-49,851m

Seasonal difference model

Point forecast:RM58,814m (2.8% yoy, 3.4% mom)

Range forecast:RM67,128m-50,500m

Technical Notes:

November 2011 External Trade Report from MATRADE.

No comments:

Post a Comment