One of the toughest challenges a writer can face is overcoming writer’s block – it’s hard to start writing again once you’ve stopped for a while. It’s even harder when there’s not much to write about, as Malaysian data over the past couple of months have been indicating an economy that’s been cruising along (in other words, b-o-o-oring).

So here’s my attempt at getting things going again. There’s all sorts of stuff I plan on covering, but it might take a while to get around to all of them, especially with my present work load (I’m currently working, among other things, on a country profile for a GCC member – not exactly helpful for thinking about the Malaysian economy).

In any case, here goes:

Money supply growth showed a sharp, unseasonal drop in November (log annual and monthly changes; seasonally adjusted):

Where’s the drop coming from? The singularly unhelpful category of “other deposits”, which suggests some BNM intervention in managing liquidity (this category replaced repos a few years back as the main indicator for central bank liquidity management).

There’s some evidence of this from BNM’s balance sheet as well, though admittedly it’s pretty thin:

The withdrawal of excess reserves and increase in monetary debt instruments has been gradual, not sharp, so some causation should be attributed to slower growth in other monetary aggregate components.

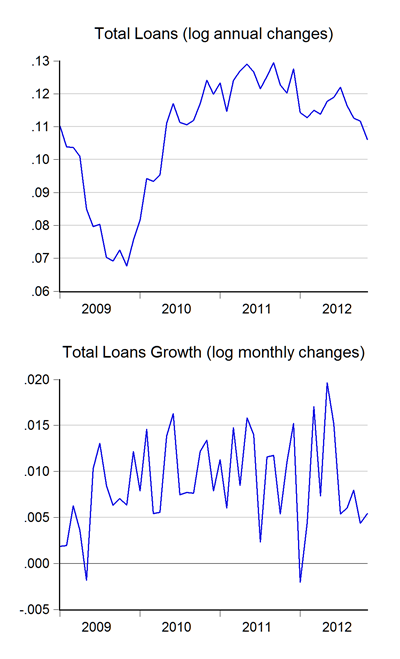

On the demand side, there’s some evidence of a credit slowdown (log annual and monthly changes):

…but clearly not as dramatic as the drop on the supply side – again evidence of intervention (forex deposit growth rates are up, so that’s not the culprit). For corroboration, here’s demand at the margin (RM millions):

It’s not a tightening of credit conditions, but a partial slowdown in loan demand, relative to 1H2012. I’m not going to make a mountain out of a molehill and claim that there’s a growth slowdown in the offing, but this is a little worrying. Having said that, with CNY around the corner, M1 and M2 are about to get a seasonal, and highly distortionary, boost.

On the interest rate front, nothing so exciting emerges from the numbers. Yields on MGS have been creeping up lately, but the yield curve has been pretty stable over the past year, with only a slight flattening on the long end:

Yields on shorter maturities have increased slightly, but since we’re talking here about interest rate increase in the 100ths of a percent, there’s no real indicator of anything going on.

On the real short end though, government securities are being snapped up – interest rates on T-Bills and BNM Bills have inched down. Again, this is only in basis point terms, and nothing implied. One interesting fact is that BNM appears to be increasing the duration of its liabilities – more than half the BNM bills issued in November was for maturities over 6 months.

Bottom line: apart from the drop in money supply growth, which bears watching, no real red flags were raised in November. I expect a bounce back in M2 growth in the December figures with CNY and end-of-year cash requirements coming up.

Technical Notes:

Data from the November 2012 Monthly Statistical Bulletin from Bank Negara Malaysia

No comments:

Post a Comment