[I’ve changed the notation to make sure there’s no confusion between the expectations operator and the exchange rate. Reminder to self: Stop making tyro mistakes. Thanks to Prof Wong for pointing this out]

I must admit I was wrong about this. I thought that of the three Rs – Ringgit, Rupiah, & Rupee – the Ringgit was fairly safe. It turns out that this isn’t precisely the case. But I’m getting ahead of myself.

One of the issues coming from the potential tapering of the Federal Reserve’s QE3 program is the outflow of capital from emerging markets, helped by concerns over growth and economic fundamentals. Markets that are seen as vulnerable, i.e. featuring budget and current account deficits, would suffer the most. In addition, countries with high foreign liabilities such as ownership in corporate securities like stocks and bonds, are also seen as potential candidates for a damaging “sudden-stop” outflow episode, a’la the 1997-98 Asian Financial Crisis.

In those terms, India (twin deficit, high inflation), Indonesia (twin deficit, high inflation and high exposure) and Malaysia (declining current account, budget deficit and high exposure) are seen as markets you don’t want to be caught in. As a result, between the end of 2012 to Sept 2013, the Ringgit (MYR) has lost 6.1%, the Rupiah (IDR) 14.8%, and the Rupee (INR) 14.4% against the USD. Never mind that these markets were also the ones that substantially benefitted from the wave of capital flows arising from easier monetary policy in the developed world.

Is this outflow justified? Yes, in the sense that these markets benefited more than most in the runup, they should also be the ones to suffer the most as unconventional monetary easing runs down. But lumping them together, as many market participants have been prone to do, is less defensible.

So I worked out by just how much yesterday.

Essentially, what I’m working with here is a version of the real interest-rate parity condition. All things being equal, exchange rates should hypothetically move based on changes in purchasing power parity and the nominal return on assets.

To put it in simple terms, higher domestic inflation reduces purchasing power and puts downward pressure on the exchange rate. Higher interest rates on the other hand, increase the return on holding domestic assets, which puts upward pressure on the exchange rate. This applies to both sides of the exchange rate – a higher domestic inflation relative to foreign inflation causes depreciation, while a higher interest rate differential causes an appreciation.

My goal is to take this intuition and show the difference between the current nominal exchange rate and where the exchange rate would be if the real interest rate parity condition holds. The difference can thus be interpreted as showing under or over valuation of the current exchange rate.

Mathematically (liberally taken from Wikipedia):

i$ – {ΔFXt*(p${t + k})} = id – {ΔFXt*(pd{t + k})}

where:

i – the nominal interest rate where $ denotes the US and d denotes domestic

ΔFXt – expected change in the exchange rate at time t

p{t + k} – the expected rate of inflation at time (t+k)

This can be rearranged to:

ΔFXt = (i$ - ic) / {(p${t + k}) - (pc{t + k})}

which basically says the same thing as the written explanation I wrote above.

[Note that the exchange rate here (FXt) is defined the number of units of domestic currency that can be purchased with one unit of foreign currency]

To make things a little easier, I take all the assumptions associated with real interest rate parity (perfect capital mobility, perfect substitutability, no risk premium) and add adaptive expectations (i.e. E(p{t + k}) = pt) such that the expected future value of inflation is the same as today's rate of inflation. I’m also flipping the exchange rate definition (FXt equals the number of units of foreign currency that can exchanged for one unit of domestic currency) to make things easier to interpret – a higher value will thus be a “stronger” exchange rate, and a lower value would be a “weaker” exchange rate.

Exchange rate data is taken from the Pacific Exchange Rate service, while inflation and interest rate data is taken from the respective national central banks or statistical offices or the ILO (see notes). I use the policy interest rate where available, and overnight interbank rates when not. The sample period is from 2004:1 to 2013:9, largely due to Indonesia having only just adopted an inflation targeting regime from late 2003 (and hence, actually having a policy rate).

Here’s the raw data (as usual, clicking on any of the charts should show you a larger version):

Currency units per USD1:

Inflation (CPI index numbers, 2000=100):

Interest rates:

And here are the generated results:

MYR (2004=100):

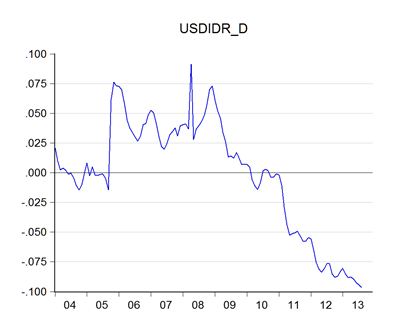

IDR (2004=100):

INR (2004=100):

How to interpret? In the charts above, the lines denoted _N are the current (nominal) exchange rate, while the lines denoted _R are the real (model generated) exchange rates:

- If the nominal line is below the real line, the exchange rate is undervalued (it should be higher);

- If the nominal line is above the real line, the exchange rate is overvalued (it should be lower).

To make things even easier to see, here are the log difference charts:

The above shows the log percentage difference (e.g. 0.1 = 10%, 0.5 = 50%) between the real and nominal lines, where a negative number denotes undervaluation while a positive number denotes an overvaluation.

The bottom line here is that – contrary to my expectations – both the Ringgit and the Rupiah have been oversold and almost to the same degree (about 9%-10% lower than they should be), instead of just the Ringgit as I initially suspected.

Indonesia’s high inflation rate is almost fully offset by the Bank of Indonesia’s higher interest rate target. Looking at the CPI chart, Indonesia’s inflation rate was high throughout the sample period, but the rate of acceleration has been slowly declining. A big thumbs up to the BOI, they’ve done a much better job than I thought.

The INR however is up the proverbial creek without a paddle and has a long way to drop. In fact, the log difference (nearly 60%) is almost identical to the one I have which doesn’t take into account interest rates. It’s as if the Reserve Bank of India and Indian monetary policy simply didn’t exist. Unlike Indonesia, India’s inflation rate has not really stabilised, and the price level is still on an exponential upward track.

I think shorting the Rupee is probably a safe bet – capital outflows due to tapering are masking deeper problems in India’s monetary regime. But I’d be a lot more careful about either the Ringgit or the Rupiah. There are other factors besides interest rates and inflation rates of course (such as macro imbalances) but from a market arbitrage perspective, selling them down isn’t justified.

Technical Notes:

- Forex data from the Pacific Exchange Rate Service

- Malaysian data from various issues of Bank Negara Malaysia’s Monthly Statistical Bulletin

- Data on India CPI from the International Labour Organisation, and interest rate data from the Reserve Bank of India

- Data on Indonesian CPI from the International Labour Organisation and interest rate data from the Bank of Indonesia

- Data on US CPI from the Bureau of Labour Statistics and interest rate data from the Federal Reserve

aik got "directional" encouragement ka bro.....bila mau start Macro Fund ni beb..

ReplyDelete:)

ReplyDeleteRupee is a no-brainer, bro. 50%+ overvaluation is like a one-way bet. They need to get inflation expectations down or alternatively, adjust downwards the path of nominal income growth. Result is the same - India requires a recession a'la Paul Volcker in 1981. Otherwise the imbalance will continue to grow. The only thing saving them now is capital controls.

They've been moving towards that with lower limits on remittances for individuals and corporates.

DeleteJust a simple question. Why is it that fluctuations in the current account are not taken into account. Can it be incorporated within the valuation formula expressed above to give a more accurate portrayal of the exchange rate fluctuation? Thanks!

ReplyDeleteexchange rate valuation*

DeleteHao,

DeleteI wish I could, but the current account model is complicated...to put it mildly.

First, it's multilateral not bilateral, which means the data requirements are pretty demanding. Second, that also implies that decomposing the results into bilateral exchange rates is no trivial task.

Third is that the base current account model assumes exports and imports are independent of each other, which is not true of Malaysia and to a lesser extent Indonesia (though I suspect it would be for India). That means the results will be biased towards showing undervaluation. There are efforts underway to address the last issue, but the data required (domestic value-added in exports) is currently only available for OECD countries.

Dude

ReplyDeleteDo you happen to have the log charts for around 1997 , 1998? Just call it curiosity killed the cat but something niggling just piqued the interest bone in me. Hope my high octane interest does not appreciate the ringgit worth of my query too much......hahaha

P/s : been busy too, will drop a line in your email for the CR thingy.

Warrior 231

Warrior,

DeleteI'm afraid I don't, largely because of data issues. Most of what is online does not go back that far. Malaysia and Indonesia (and Thailand) really upgraded data collection and statistical publication after the crisis, but data before that period can be hard to access.

But you can reference the first post crisis IMF country report, which has two models estimating the equilibrium REER for Malaysia (Section II on exports and competitiveness).

DId I ever tell you that my Masters thesis was on this very subject? But I covered 1972-2007.

ReplyDeleteHere's another reference (gated though):

http://ideas.repec.org/a/bla/asiaec/v22y2008i2p179-208.html