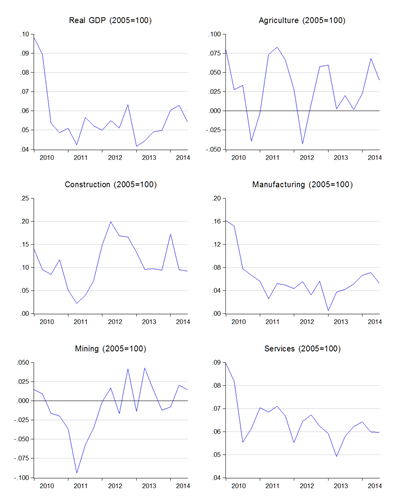

I’m still torn. Last week’s GDP report was a little better than I thought, but might just be the best growth we’re going to see for a while (log annual and SAAR changes):

Note that while annual growth is holding up pretty well, quarterly growth in 3Q2014 is actually the weakest in nearly two years. There’s little in either the global or domestic economy to suggest that growth will get any better over the short term.

Looking at the demand side certainly suggests weakening momentum (log annual changes):

Both exports and imports have turned down, and investment growth has dropped to near zero. Private consumption is holding up, but there’s a lot of future headwinds coming in, from subsidy rationalisation, weaker wage growth, and GST on the horizon.

On the supply side, growth is slowing across the board (log annual changes):

Construction growth is still strong, but construction is a very small sector of the economy. Both manufacturing and services growth have turned down a little.

So far so good. But the immediate prognosis is that growth will slow even further (log annual changes):

My best guess is that we’ll see GDP growth dip below 5% in 4Q2014, to between 4.6% and 4.9%. Based on current trends that will be the worse of it, and it’ll still bring 2014 growth as a whole to 5.7%-5.8%. Growth in 2015 will be a little weaker, but in contrast to 2014, will largely be back-loaded instead of front-loaded as it was this year, with the strongest growth slated for 2H2015 (where have we heard that before?).

I’m still concerned however – one of the weaknesses of using statistical models based on historical data is that there’s a tendency towards mean reversion and stability. There’s a whole lot of stuff going on right now that could derail growth, not just for Malaysia but the world as a whole. Growth stability has been more the exception than the rule.

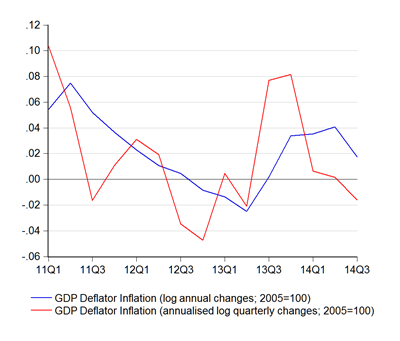

More to the point, the GDP data confirms my real worry is coming true (log annual and SAAR changes):

Nominal GDP growth is turning down again, and rather sharply at that. The quarterly growth in the GDP deflator series has also turned negative (log annual and SAAR changes):

It’s nowhere near as bad as in 2012-2013, but if anything, prices have been trending even lower in 4Q2014. In case you’re missing what this means, negative deflator growth indicates we’re producing relatively more than we’re earning. The implication is that income growth – whether that of households or of companies – will probably disappoint over 2H2014, and even into 2015 if global price trends continue. This is already turning up in my wage data.

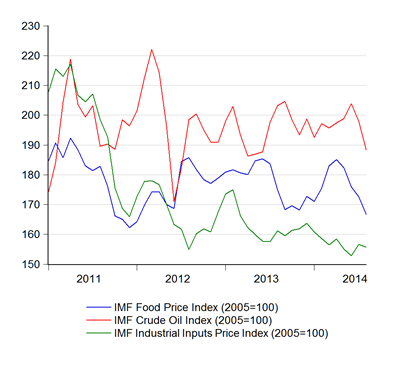

This isn’t purely a story about oil or USD strength either (index numbers; 2005=100):

While global oil prices have retreated, so have global prices for food. Industrial inputs (metals + raw agro materials) on the other hand have been relatively steady over the past year i.e. global demand was already weak. Some of this is cyclical, but there’s a sense that, for oil prices anyway, we’re likely to see an extended period of weak energy prices.

That’s a boon for the global economy as a whole as this will help sustain growth, but commodity suppliers like Malaysia and Indonesia will find it challenging to keep income growth up, especially for rural communities dependent on agricultural output.

We’re heading back to a two speed economy, where real growth won’t translate to money in wallets and the only thing keeping Malaysian growth going will be infrastructure investment.

Technical Notes:

- 3Q2014 GDP report from the Department of Statistics

- Commodity price index data from the IMF

No comments:

Post a Comment