I’ve left this off the blog for a very long time, but with so much interest know on the exchange rate, it’s time to revive this particular zombie.

We all know the Ringgit has depreciated significantly against the US dollar in the past half year:

One Ringgit now buys US 29 cents, compared to 33 cents a year ago.

What’s been a lot less obvious is that the Ringgit has hardly been alone in this. While the MYR has suffered more than most, it’s not the worst off by any measure. Most commodity producing countries have endured a currency sell-off (sans those running currency pegs). Here for instance is the how much Canadian and Aussie Dollars one Ringgit buys:

Both Canada and Australia are also large commodity/energy exporters. The big difference is that neither Canada nor Australia have any hang-ups about pushing down their own currencies in the face of a terms of trade shock (a.k.a. a sharp drop in iron ore and oil prices). It’s simply good economic sense and pragmatic policy making.

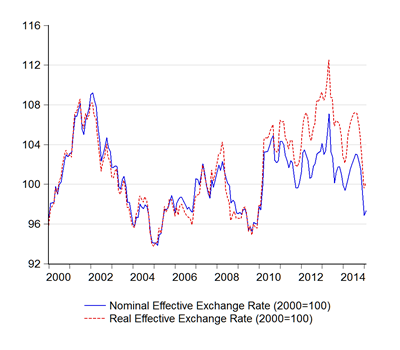

But in totality, there’s no doubt the purchasing value of the MYR has declined. What might surprise most people is that there hasn’t been that big a decline, at least in aggregate terms (index numbers; 2000=100):

The nominal effective exchange rate has dropped a little over 5.6 points from July to the trough in January this year; the real (inflation-adjusted) effective exchange rate a slightly sharper 7.5 points. It’s a bigger drop from the last peak (May 2013), but then not many people may have noticed, due to the international convention of quoting everything in USD.

There are a couple of ways to look at this, in valuation terms. First is to use the base year as a kind of benchmark, and take deviations from this as a measure of under/overvaluation. In those terms, the MYR is currently undervalued by about 2%-3% in nominal terms, and fairly valued in real terms. I’ve never been happy with this approach, because there’s really no theoretical basis for it and you’re making the very large assumption that mutlilateral exchange rates and economic fundamentals are more or less balanced in the base year.

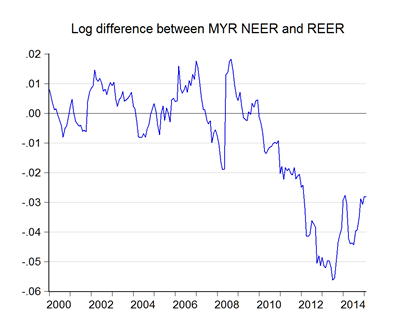

Second is to look at the difference between real and nominal exchange rates as a (short–term) indicator of over and under valuation. That makes more sense, as the nominal exchange rate should converge to the real rate over time, via a variety of mechanisms (interest rate parity, purchasing power parity etc).

Which gives us this:

This also puts the undervaluation of the MYR at about 3%, so not really all that far away from the approach used above. I have to stress however, that this is really an indication of bias – there will be (or should be) a tendency for convergence, not that it will happen or how quickly.

How do these translate into every day exchange rates, do ones we use to buy or sell currencies? Quite simply: it doesn’t. The NEER/REER is really only useful as a measure of trade competitiveness and currency misalignments, and as inputs into policy. It won’t tell you where the misalignments and valuation differentials comes from, though with a breakdown by components, it shouldn’t be hard to tell.

And here we have a very mixed tale (log difference since July 2005):

Since the floating of the Ringgit in 2005, the MYR is significantly lower against the CNY and SGD, but generally up against the USD, JPY and EUR. The sharp recent fall against the USD is almost offset by the equally sharp run-up against the JPY.

Against ASEAN, it’s again a tale of two halves – massively up against the Rupiah and the Dong (though there’s been a bit of a pullback recently), while down against the Peso and the Baht.

Against the other East Asian tigers, the MYR has lost quite a bit of ground in the last six months, but is still holding on to gains. Rounding it up, here’s the rest:

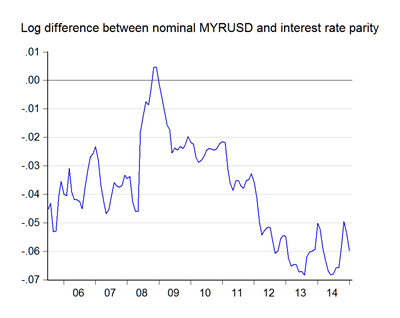

Here’s the equivalent log differential chart, implying a current undervaluation of around 5%-6% or so:

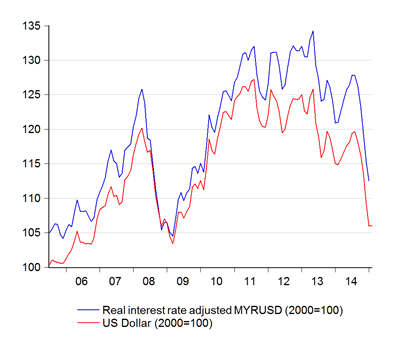

In every day (USD denominated) terms, here’s the chart (click on the chart to view a larger version):

Last note: the above implies a persistent undervaluation of the Ringgit with respect to the US Dollar. There may be a number of reasons for this that could explain it away, without getting into dark mutterings about currency speculators and/or official manipulation:

- Given the US Dollar’s status as the global reserve currency, there will always be an excessive international demand for USD (and thus lower real interest rates) over and above that determined by economic fundamentals alone. As such, the USD is always structurally overvalued to some extent, though this may have declined over time as central banks have generally been moving away from an overconcentration in USD reserves;

- The undervaluation might reflect a difference in perceived (and unobserved) risk premium;

- Equivalently, this could be taken to be a difference in credit standing (AA+ rated against A-)

That last one might be an idea I might pursue further, as it gives a numerical measure to test against (unlike the risk premium).

Technical Notes:

All FX data from the Pacific Exchange Rate Service

I note that Zeti is talking up the Ringgit. She says it is undervalued. Fair enough.

ReplyDeleteWhat I find a tad unsettling is the report that she is asking rating agencies to judge Malaysia "fairly" with due regard to the country's economic fundamentals.

I don't know if she was misquoted or misreported in this regard.

Julia Leung's op-ed piece "Towards an Asia-style monetary framework" (Singapore Business Times, Feb 25) shows that Asian central bankers have nothing much to apologise for.