The Monetary Policy Committee will be meeting this Thursday and the consensus opinion is that there won’t be any change. I don’t think so either, but pressure will be mounting.

BNM won’t be the only central bank deciding on monetary policy this week. Also on the clock are Australia, Canada, Brazil, Poland, Albania, the UK and the ECB. I expect no change from the latter two with the ECB having already pre-announced the start of Euro-area QE beginning this month and the BOE likely to stay the course. Brazil was the odd man out, with a 50bp hike in January.

But the other four countries (Australia, Canada, Albania and Poland), all shaved their policy rates in the past two months and could potentially ease policy again. The two critical ones for Malaysia are Australia and Canada – both are big energy producers and exporters, and both have suffered negative terms of trade shocks from declining oil & gas prices. That similarity alone would be enough to raise speculation of a rate cut by BNM. The fact that their economic exposure is comparatively smaller makes the case for a Malaysian rate cut even more compelling.

What differentiates Malaysia from them though is where we are in the business cycle. Both Canada and Australia have seen their non-oil economic growth slow, whereas Malaysia is seeing a pickup in the electrical and electronics sector.

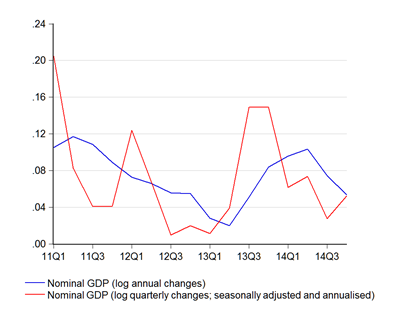

I’d actually argue for a rate cut (while talking down the Ringgit) as a bigger buffer against the oil price decline. Nominal GDP growth is weak, and likely to get weaker in the first half of this year (log annual and quarterly changes):

The GDP Deflator has already turned negative and would dive deeper into negative territory this year (log annual and quarterly changes):

We’re already facing some headwinds from slowing wage growth, a potential consumption shock from GST, cuts in oil & gas capex, and weaker than expected government expenditure. Money supply and bank lending growth have continued to moderate, indicating weaker economic activity. That’s a decent case for contemplating an easing in monetary policy, if not at this meeting then at the next one.

The flip side is: we still have concerns over household debt and debt servicing, real production is still robust, and the employment implications from slower oil & gas revenues is pretty minor. This could be a transitory phase, until the economy adjusts. Long term, a decline of the O&G sector could be a blessing in disguise – it forces the government to diversify away from O&G based revenues and it vaccinates the economy from Dutch Disease.

On balance, don’t bet on any change this week.

Hishamh, i'm rather hoping for a drop in interest rates so that stock prices will pick up cos i need to monetise some of my stocks to pay for my house renovations LOL

ReplyDeleteChina has cut interest rates for the second time in 3 months. The RMB is under pressure, with another 100 bps cut in reserve requirement ratio and another 25 bps cut in the deposit rate by year-end.

ReplyDeleteUOB and Credit Suisse expect the RMB to weaken further to 6.33 against the USD.

Fred Neumann (co-head of Asian Economics Research at HSBC) said there "could be increased expectations among China's neighbours to engineer similar depreciations to maintain their competitiveness."

According to him, Asia would feel the pain foremost. The Business Times reported his view that a weaker RMB could hurt the export competitiveness of economies like Malaysia and Thailand and the profit margins of companies in Korea, Taiwan and Japan that sell directly to customers in China. He also said that it may raise worries for Singapore and Hong Kong that mainland borrowers might struggle to repay loans from banks in these cities.

So, will BNM be keeping it's powder dry?

More to the point, is the Malaysian economy in good enough shape to be able to cope with a prolonged bout of MYR weakness?

@anon

ReplyDelete1. The MYR is nearly 14% down against the CNY since 2010. I wouldn't worry about Malaysia's competitiveness versus China's, especially since unit labour costs in China are now virtually on par with Malaysia i.e. China is not a low cost producer anymore.

2. "More to the point, is the Malaysian economy in good enough shape to be able to cope with a prolonged bout of MYR weakness?"

You have it precisely backward, rather ironic when juxtaposed with what you quoted above that statement.

Well, if China is "not a low cost producer anymore", as you have stated, isn't that grounds for concern?

DeleteWhy would foreign investors, for example, want to invest in Malaysia when they can do so in China, and have the vastly bigger China market as an added bonus?

And, picking up on your 2nd point, my question is what will happen if the MYR stays weak when central banks in the region seem to be adopting an easing policy?

If the Fed reverses QE decisively, will there be a flight from "emerging markets" currencies and assets to the USD and USD-denominated assets?

@anon

DeleteI've no idea where you're going with this.

1. China as a bigger market was true yesterday, is true today, and will be true tomorrow. Yet foreign investors still come to Malaysia. Wage competitiveness however has changed. I don't see why this is a concern, especially with both Malaysia and China both tied into the East Asian supply chain. We don't exactly compete with each other - a lot of East Asian trade is complementary.

2. Sorry, why would this be bad? Isn't this to Malaysia's benefit?

3. QE ended last September. The movement into USD denominated assets started in May 2013, and really accelerated beginning July last year (try the one year chart):

http://www.marketwatch.com/investing/index/dxy

That's one reason why the both oil and the Ringgit have dropped. About a quarter of the drop in oil comes solely from a stronger USD. If you look at the MYR on a trade weighted basis, the Ringgit hasn't dropped nearly as much as implied by the USD exchange rate:

http://econsmalaysia.blogspot.com/2015/02/january-2015-currency-update.html

Hi hisham,

ReplyDeleteReally like y comments but having problem catching up since im just an ordinary person. How do you translate the log annual and quarterly into indicator?

@anon 11.44

DeleteIt's just another way of calculating percentage change, and results in nearly the same numbers. There are advantages to economic modelling and statistical testing by using log differences instead of percentages, which is why I use log changes for convenience.

Don't worry about it, just take the scale as being in percentage terms i.e. 0.02 = 2%, 0.04 = 4% and so on.

Thanx bro.

DeleteLook fwd also yr post on matters affecting the mid low mass. CPI, purchasing power etc