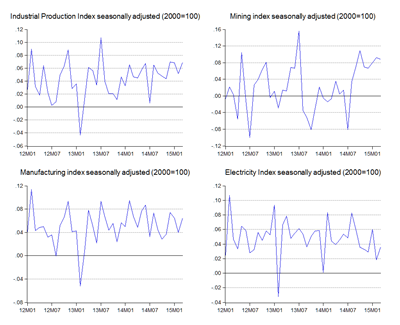

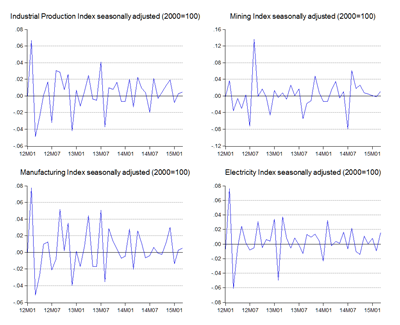

Well, well, well (log annual and monthly changes; 2010:100):

If the demand side looks less than strong, there’s nothing wrong on the supply side of the economy. After a c0uple of months of weak results (both in production and exports), industrial production has come back up. Annual growth hit 6.9% in log terms, underpinned by manufacturing growth (6.5%) and mining output (8.8%).

I think this is going to be a recurring feature this year, where output growth exceeds export growth. This says less about domestic demand than it does about inventories – the economy has been running down inventory for six straight quarters (from 3Q13 to 4Q14), and its due for a spate of restocking.

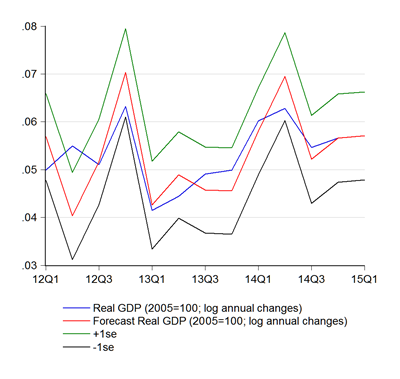

The upshot is that 1Q15 GDP growth will probably surprise on the upside (log annual growth; 2005=100):

Based on the IPI alone, 1Q15 GDP could hit 5.7% in log terms (one standard error: ±1%). The weighted average forecasts suggests a more moderate 4.9%-5.3%. Whichever the case, this is far better than expected by most, and likely to hit the higher side of these forecasts, especially as the sector breakdowns show some very strong numbers.

The distributive trade sector hit 7.1% in 1Q15, with retail trade expanding sales by 11.3%, totally at odds with the reports coming out of retail trade associations. The construction sector on the other hand grew 15.1%, while manufacturing was relatively flat. Note that DOS is issuing for the first time a report on the overall Services sector, which includes not just distributive trade, but also finance and real estate, communication and storage, as well as other services.

Technical Notes:

All data from the Department of Statistics:

- March 2015 Industrial Production Report

- 1Q15 Distributive trade index report and sales survey

- 1Q15 Construction sector statistics

- March 2015 monthly Manufacturing statistics

- 1Q15 Services sector index report

No comments:

Post a Comment