Yesterday’s MPC statement is about as clear a statement of intent as you can get from a central bank (excerpt; emphasis added):

...At the current level of the OPR, the stance of monetary policy remains accommodative. Given the strength of the global and domestic macroeconomic conditions, the Monetary Policy Committee may consider reviewing the current degree of monetary accommodation. This is to ensure the sustainability of the growth prospects of the Malaysian economy....

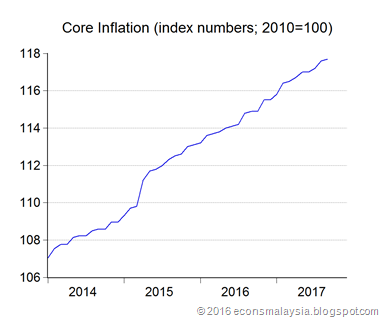

Now the question shifts from “if” to “when”. The inflation numbers won’t help much, because of the noise from rising oil prices. Core inflation isn’t giving any signals either:

The slope has been slightly elevated for most of 2017, but not by very much. Personally, I’ll be watching wages very closely the next few months, as well as bonus payments during Chinese New Year. One other factor: bank lending has been affected by Basel III implementation and might also be capped by the adoption of the MFRS9 accounting standard next year. That might push back the timetable for any OPR hike, since monetary policy largely depends on the banking system as the transmission mechanism (the contrarian argument: since loan growth will underperform anyway, might as well raise rates since it won’t cause much harm).

Also, I should mention something that most analysts seem to have missed: in January, the EPF contribution rate reverts to the 11% level from the 8% rate that has prevailed since April 2016. By my estimate, that takes roughly RM2-4 billion in disposable income off the table next year. Again, something that might push the timetable back for a rate hike. Having said that, the last few months wage numbers have been really, really solid, and the contribution rate increase might only be enough to take some of the edge off domestic demand growth.

Lastly, more or less on schedule, manufacturing and trade growth are starting to soften, not just for Malaysia but across the region. I’ve always been sceptical of the argument that “this time is different” and we’ll continue to see the semiconductor cycle continue up into next year. There are some differences this time, but not enough I think to sustain the kind of double digit growth rates we’ve seen for most of 2017. We’re almost past the base effect from the regional trade recession that has prevailed from 2015-16, so again, the next few months numbers will be crucial.

Hisham,

ReplyDeleteBig-picture question on inflation:

Does Malaysia's high and uptrend inflation, as compared to the opposite in the other ASEAN-6 countries, worry you?

I mean, the world is in an era of tech-driven deflation and low commodity cycle, but Malaysia macam dah terbalik.

@Fung

DeleteI don't see a consistent divergence in inflation across the region. The Philippines has almost the same trajectory as Malaysia. Some of the rest (Vietnam, Indonesia) are being affected by weather related food price volatility, while Indonesia also retains fuel subsidies. Singapore is suffering from low wage growth and low domestic demand. Ditto for Thailand.

Malaysia's high inflation is almost entirely due to petrol prices. Core inflation remains fairly steady at 2.4%.

En Hisham,

ReplyDeleteIn your opinion, at current level of petrol prices and inflation rate, is there any measure should be taken by government without passing the increasing cost to people? Example; reinject subsidies

Yes agree...give subsidy lah..

Delete@Khairun

DeleteI have written and argued for the last 7 years that petrol should be taxed, not subsidised:

http://econsmalaysia.blogspot.my/search/label/Pigovian%20tax

In any case, my belief is that housing is a bigger factor in cost of living than anything else:

http://econsmalaysia.blogspot.my/2017/04/chart-of-week-malaysian-house-price.html

Also, read this:

Deletehttp://econsmalaysia.blogspot.my/2017/09/housing-inflation-and-cost-of-living.html

Hisham, I think gov should come with Reit system for housing like in Japan. Not necessary all people must buy house.

DeleteDon't mean to be a stickler, but it's reverts and not reverts back.

ReplyDeleteCheers!

@avidreader

DeleteYou're a person after my own heart!

Thanks and fixed.