The US likes to go its own way on many things, from using the imperial system of measurement (feet, pounds, miles) to American Football. In monetary policy, the Federal Reserve - which itself is an awkward conglomeration of 12 privately owned regional banks rather than a properly constituted central bank - uses Core PCE inflation as its primary policy target, unlike virtually every other central bank in the world, which use the Consumer Price Index. Since I was playing around with the GDP data, I'd thought I'd might as well do a comparison for Malaysia. It turns out there's not a whole lot of difference, but what differences there are, are really interesting.

First some theory, and why differences exist between these two measures. The CPI is fixed basket of goods and services, where the choice of components is determined by a household expenditure survey at some reference period. Holding the basket constant allows for clear measurement of changes in costs, and the basket is periodically revised to take into account changes in consumption. The PCE price index isn't a fixed basket, and components are effectively whatever people happen to be spending on right now.

The plus point is that this takes into account substitution effects, as people will switch away from goods or services where prices have increased to lower cost alternatives. This is especially important when there are large swings in prices (either up or down), as the CPI would tend to ignore such changes and thus overstate or understate actual inflation. On the debit side, this difference really muddies the water when trying to measure changes in living standards, as substitution does not imply there are no changes in quality.

From a practical perspective however, calculating PCE can only done quarterly due to having to measure both prices and quantities under the national accounts, as opposed to the CPI where you measure quantities maybe once in 5 years, and only have to collect prices on a regular basis. In that sense, the CPI is more operationally useful, since the frequency is higher. Also, PCE (which is really a subset of the GDP Deflator) is an implied index, not one calculated from the bottom up like the CPI (see the Technical Notes at the bottom of this post for details). Trying to estimate it from raw data would be a nightmare, given that the weights will change at every observation.

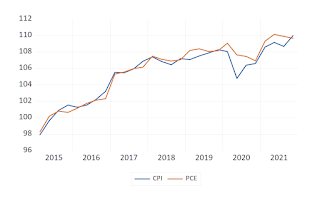

With that out of the way, what does PCE look like for Malaysia? (index numbers, 2015=100):

1. GDP data from DOSM

2. The GDP Deflator is an implicit price index that is calculated simply as NGDP/RGDP*100, and shows the impact of changes in prices across the whole economy. Some people (I will not name who) claim this is a better measure of inflation than the CPI, since it takes into account all prices and quantities, whereas the CPI only takes a subset. This is bogus, because the Deflator also includes export prices, which obviously don't have any bearing on domestic inflation. But taking this approach as a departure, PCE can be calculated by simply dividing nominal with real final consumption expenditure. This yields a measure of inflation that more directly relates to the price pressures households face. In principle, you can derive the implicit price series for any of the components of GDP this way. Another interesting application of using this approach is on the supply side, which yields a measure that potentially correlates with profit margins.

No comments:

Post a Comment