Gold: Store of value

Low returns on other investments and fears about the world economy have caused the price of gold to soar. Don’t count on its continued rise

Jul 8th 2010 | Delhi and London

ON THE kind of hot, sultry day in which the brutal Delhi summer specialises, the attractions of lingering languidly over gold jewellery in air-conditioned comfort are easily understood. Yet customers are thin on the ground in the jewellery section of the Central Market, an unruly hive of commerce in the middle-class district of Lajpat Nagar. “Business has never been this slow in the 14 years that I’ve run this place,” complains Mrs Anand, owner of Hans Jewellers. Lajpat Nagar’s jewellers estimate that sales are down by 40% or more on a year ago.

In a typical year India soaks up perhaps a quarter of all the gold mined in the world. Now, however, not only are people not buying; more and more of them want to swap their gold jewellery for cash. Jyoti Pal, a shop assistant, reckons that these days about as many people come in to sell as to buy. Suresh Hundia, president of the Bombay Bullion Association, goes further: “There are only sellers in the market at these prices and most jewellers are buying back only old jewellery.”

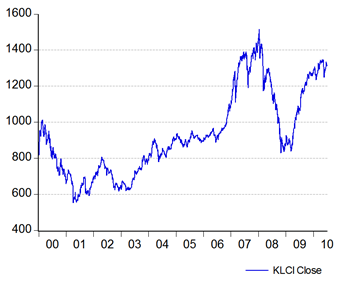

Middle-class Indians have been turned from buyers to sellers by the rapid increase in the price of gold in the past couple of years. The seemingly insatiable demand of mainly Western investors, drawn to gold as a store of value rather than as an adornment, has driven the price from less than $700 an ounce in 2007 to more than $1,200 since May this year. Last month it reached its highest-ever point in nominal terms, $1,264.90. It has eased a little since, sliding below $1,200 this week. After adjusting for inflation (measured using American consumer prices), in recent weeks the gold price has been at its highest for 30 years—although only just over half its all-time high (see chart 1).

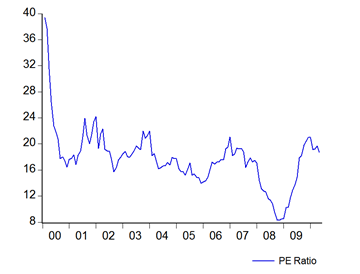

In both the Central Market and the international financial markets, there is no shortage of people who believe that the price will resume its ascent. Ronald Stöferle, an analyst at Austria’s Erste Group, points out that the value of American gold holdings amounts to about 1.85% of the country’s GDP. In 1940 it was above 20% and in 1980 close to 7%. This, he argues, points to continued demand for gold from investors. He expects the gold price to hit $2,300 by 2012.

The appetite for gold arises partly from the paltry, uncertain returns from more conventional investments. Gold’s main drawback is that it pays neither a dividend, like a share, nor a coupon, like a bond, nor a rent, like property. But monetary policy has been keeping official interest rates, and thus the opportunity cost of holding gold, low and seems set to do so for a while. The yields on the government bonds investors regard as safest, notably America’s and Germany’s, are also thin. Equity markets are weighed down by worries about economic growth. Investing in property, which lay at the root of the financial crisis, requires a boldness that many still lack.

At the same time, the looseness of monetary policy has made many investors fear the eventual resurgence of inflation. The wretched state of many governments’ finances makes some worry about states’ ability to repay their debts—or about the temptation to inflate them away. Banks’ exposure to sovereign debt and to a still-fragile world economy adds another layer of concerns. And when all governments would like their currencies to be weaker rather than stronger, whose paper money do you trust? Hussein Allidina, head of commodities research at Morgan Stanley, reckons: “Gold looks better every day with growing sovereign risks.”

Some gold bulls argue that the long-term prospect for gold prices is bright even if these fears subside. Income per person in China and India, the biggest markets for jewellery, is racing along, the reasoning goes, and this should support the market.

But the price surge has had others shaking their heads. As an investment that does not produce income, its attraction lies solely in the hope that its value will rise or at least be maintained. As a metal, its main use is in jewellery. It defies logic, say the bears, that its price should remain so high without any fundamental change in the sources of demand or constraints on supply. Willem Buiter, a former professor at the London School of Economics who is now the chief economist of Citigroup, has called gold the subject of “the longest-lasting bubble in human history”. He says that he would not invest more than a sliver of his wealth “into something without intrinsic value, something whose positive value is based on nothing more than a set of self-confirming beliefs.”

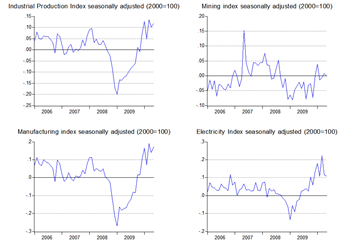

At the root of this debate about the durability of the gold-price rally are different beliefs about the future path of demand and supply. There have been notable shifts on both sides of the market, serving to push up the price of gold. These predate the global financial crisis: between 2003 and 2007, when some investors were already beginning to doubt the sustainability of the boom in property and share markets (as well as the wisdom of monetary policy and the prospects for global growth), the price more than doubled. But since the crisis these doubts have intensified, generating the recent leap in the price.

Start with the demand side (see chart 2, top panel), which has two main parts: demand for gold as jewellery, and demand for gold as an investment. (Some is also used in industry and dentistry.) Jewellery has conventionally accounted for the lion’s share, but it has been declining in both absolute and proportional terms. Between 2000 and 2007 global gold-jewellery demand slid from 3,205 tonnes to 2,417 tonnes; as a share of the total demand for gold, it declined from nearly 80% to just over 60%. The fall was precipitate in the Western world. Demand in India, the biggest jewellery market, was little affected until last year. Demand in China, the next biggest, has continued to rise.

As jewellery demand went down, investment demand went up: for gold in the form of coins or bars, for gold exchange-traded funds (ETFs) and for the services of online companies that allow investors to buy small amounts of pure bullion, stored in underground vaults. Buyers of jewellery might be put off by a rising price; investors are more likely to see it as a sign that the price will increase further still. Annual “identifiable investment”, as the World Gold Council puts it, was 611 tonnes in 2004-07, a little more than twice the average for the four previous years. That just about offset the fall in jewellery demand.

Since then, however, investment demand has accelerated and jewellery demand has collapsed. Last year, indeed, was the first in which investment demand exceeded jewellery demand. Purchases of gold for jewellery dropped to 2,193 tonnes in 2008 and then to 1,758 tonnes in 2009. Meanwhile, the signs of surging investment have been everywhere. This has more than made up for the slump in the jewellery trade: total demand in 2009 was the highest since at least 2000.

Investment in gold ETFs and similar products reached a record high in 2008, of 321 tonnes—and then almost doubled, to 617 tonnes, last year. The stock of gold held by such funds more than doubled to 1,839 tonnes in the two years to the end of 2009. John Paulson, a New York hedge-fund manager best known for making handsome sums betting on the collapse of the American subprime-mortgage market, holds $3 billion-worth of gold ETFs, the largest part of his $35 billion portfolio.

The 229 tonnes of gold sold in the form of official coins last year was the most since 1986, thanks to demand from retail investors in America and Europe. In November demand for one-ounce American Eagle coins was so strong that the American mint ran out of supplies. Rand Refinery, producer of the blank coins which the South African mint turns into Krugerrands, raised its output to 30,000 ounces in the first week of June, the highest rate of production since 1985. In Abu Dhabi those seized by an urge to buy bullion can now head to the lobby of the Emirates Palace hotel, where the Gold-to-Go machine dispenses bars.

Adrian Ash, head of research at BullionVault, one of a number of web-based bullion dealers which allow customers to buy titles to gold bars stored in vaults deep beneath the ground in London, New York and Zurich, reports that business is booming. The sources of Mr Ash’s business are a guide to the sentiment driving many investors into gold, some of them for the first time. In the first half of May the crisis in the euro area was uppermost. Worries that the burden of some countries’ sovereign debt might precipitate a collapse in the euro were stemmed only by the extraordinary measures taken by the European Union, the IMF and the European Central Bank (ECB). At that time, 41% of BullionVault’s new customer deposits came from euro-zone banks, about twice the average since January 2009.

The other big worry is inflation, even though economies in the rich world surely still have more to fear from deflation. Some investors fret that the huge amounts of money created as central banks have rolled out bond-buying programmes or lent to banks will eventually create inflation on a grand scale. At least some of BullionVault’s customers are probably Germans unconvinced by the ECB’s “sterilisation” to offset the monetary effects of its bond purchases.

For investors in gold who think of it as an alternative to paper currencies, its attractiveness is intimately linked to their fears about the capacity of these other currencies to retain their value. Unlike gold, they argue, the value of paper currencies depends on the whims of governments, which can fuel inflation by printing it at runaway rates. Paul van Eeden, a veteran Canadian investor and a student for many years of the gold price and its relation to monetary aggregates, says he suspects that “what’s driving the gold price higher is the sentiment within the market that European and US central banks will eventually be forced to do more quantitative easing.”

Some worry that the crisis has eroded the intellectual consensus that has kept inflation in check in the rich world for the past 20-30 years. For example, a few months ago Olivier Blanchard, the chief economist of the IMF, suggested that central banks might do well to raise their inflation targets from 2% to 4%. The fear is that governments might inflate away their enormous debts: whereas medieval kings adulterated their coins with base metal, today’s rulers may debase their money simply by creating more of it.

On the supply side (chart 2, bottom panel), the main source of new gold—what is dug out of the world’s goldmines—has been flat or declining. Mine production peaked in 2001 at 2,646 tonnes and has been a little less than that ever since. A combination of rising production and exploration costs, dwindling output from long-established mines in North America and South Africa, and political and economic instability in other parts of Africa means that mine supplies cannot be ramped up at will.

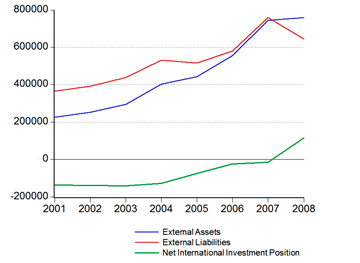

Another potential source of supply is sitting in the vaults of central banks. In June national central banks, the ECB and the IMF held more than 30,000 tonnes in all. On average, they sold 520 tonnes a year between 2000 and 2007. Last year the flow of central-bank gold almost dried up, even as the price soared. Only 41 tonnes made it to market. Some bulls argue that central banks will at some point become net buyers. However, this week China’s foreign-exchange agency said gold would not become an important element of the country’s official reserves.

The third main source of supply is scrap: jewellery sold to dealers for the value of the metal. While the price was rising steadily in the first few years of the century, scrap sales did not respond: in 2003, when the price averaged $300, 986 tonnes were sold; in 2007, when the price was $700, the amount was four tonnes smaller. But as the price has climbed steeply since, record quantities have been sold for scrap—1,674 tonnes last year.

The sellers include middle-class Indian housewives, who habitually put their savings into gold jewellery. Last year Indians sold 115 tonnes from their private collections, a third more than in 2008. In Turkey, where 217 tonnes were sold back to jewellers, the deputy head of the Istanbul Gold Exchange says that “a widespread belief that gold is overpriced” is leading some to sell “anything they have”. Some sellers may also be feeling the pinch. Last year scrap sales leapt by nearly a third in America, where companies that allow people to mail jewellery in have helped drive up supply. “Cash For Gold paid me $829 for gold jewellery I never even wear!” screams one firm’s website.

Where the gold price heads in the future depends on the answers to three questions. First, for how long will investors keep piling into gold? Second, if and when they quit the market, will the demand for jewellery revive enough to support the price near recent levels? Third, how will supply respond if the price stays high?

The answer to the first question lies largely in the state of the world economy. Western investors’ new interest in gold has coincided with the rich world’s deepest period of economic turmoil since the 1930s. Harold James, a historian at Princeton University, argues in his latest book, “The Creation and Destruction of Value”, that crises lead to a fundamental uncertainty about what things are worth. In a world of unpredictable currencies, riven by fears of massive inflation and with enormous doubts about the true value of many other financial instruments, gold becomes an attractive option.

Yet at some point either the worst fears of the gold bugs must be realised—in which case, heaven help us—or the world will become a less nervous place. When interest rates eventually rise, the opportunity cost of holding gold will go up, taking off the shine. When the overall economic climate improves so that uncertainty about the prospects of companies is no longer so pervasive, that will provide another reason for some investors to retreat from gold. And even if inflation rates do increase, argues Mr van Eeden, they are unlikely to be high enough to justify the prices at which gold has been trading. These things suggest that the swelling in investment demand in 2009 and the first half of 2010 cannot last indefinitely.

At that point, the second and third questions will become pertinent: will demand for jewellery be strong enough at today’s prices to compensate for the falling away of interest from investors in the West, and how will supply respond? The gold industry would hope for vigorous jewellery demand in its traditional markets, mainly India and China. Indian demand, especially, has long been reliable. In the early 1770s Alexander Dow, a veteran of the East India Company, marvelled at the country’s thirst for precious metals, calling it “the sink where gold and silver disappeared, without the least prospect of return.”

Nevertheless, the experience of the past year suggests that accounts of India’s eternal attachment to gold are somewhat overplayed. Although Indians have continued to buy at high prices, they have done so in ever smaller quantities: purchases last year, at 480 tonnes, were more than 200 tonnes lower than in 2008. Jewellers in Lajpat Nagar see a clear trend towards buying less gold than was earlier considered socially acceptable. “Where three sets were mandatory for a wedding,” one says, “two are now fine. Maybe even one.” Mr Hundia reckons that India’s gold imports will probably fall by 40% in 2010 from 343 tonnes last year. In any case, India and China would have to more than triple their annual purchases just to soak up the world’s newly mined gold.

All this suggests that the traditional markets for gold cannot be expected to pick up the slack if rich-world investors’ appetite should pall. And if prices remain high, more of the world’s existing stock will augment supply. In theory, there is a lot more that could be sold for scrap. Gold’s boosters are fond of pointing both to the roughly 4,000 tonnes traded every year and emphasising that “all the gold that’s ever been mined is still around”—glossing over the contradiction in emphasising both limited flow and abundant stocks. Some reckon the world’s total stock of gold to be about 160,000 tonnes. Only a fall in the price can hope to restore balance to the market, by boosting demand and restricting scrap supplies.

As the world economy returns to business as usual, the gold market may also return to some semblance of normality. Only when the price retreats will the housewives of Delhi go back to being net buyers. Over the years, as they get richer, their demand may increase. Or they may find other kinds of financial instruments increasingly attractive as the Indian financial market deepens. As long as the world economy remains uncertain and investors fear inflation and sovereign default, gold will keep its allure. Eventually, however, the price will weaken: it is even possible that the recent slide to below $1,200 marks the turn. And investors may look back on the bull run of 2009-10—or 2009-11—with the sort of wonder that humanity has too often reserved for the yellow metal itself.