From Businessweek yesterday (excerpt):

Why China Is Suddenly Content with 7.5 Percent Growth

For years, there’s been one constant for people talking about the Chinese economy: GDP growth would exceed 8 percent. It didn’t much matter what happened in the rest of the world—the U.S. and other export markets might be thriving or might be struggling, but China would grow at least 8 percent, year in and year out. The country needed to create enough jobs for the millions of young people entering the workforce every year, and the Chinese leadership decided that anything below 8 percent would put job creation in jeopardy...

...That magic, 8 percent number, though, is now history. At his annual address to open the National People’s Congress in Beijing, Chinese Premier Wen Jiabao on March 5 announced that the government has a GDP target of 7.5 percent this year. China hasn’t had a growth target that conservative since 2004.

The European debt crisis is one culprit, with demand falling for Chinese exports. But it’s not just about the Europeans. After years of torrid growth of at least 9 percent, China needs “higher-quality development over a longer period of time,” Wen told lawmakers at the country’s parliament. Economists and investors agree that China is now entering a new era of slower growth, one where the old 8 percent figure is no longer so important...

...And what about the job-creation imperative that made the 8 percent target so critical for so long? China is going through a major demographic shift, thanks to fast economic growth and the one-child policy. As the population starts to age, job creation for millions of young people isn’t so vital anymore. While China needed 10 million new jobs a year in the early 2000s, today it needs just half that number, says Jian Chang, China economist in Hong Kong with Barclays Capital. “The labor force as a whole is barely growing now,” says Stephen Green, head of Greater China research for Standard Chartered Bank in Hong Kong. As a result, Chinese policy makers “just don’t need to create as many jobs as they [once] did.”

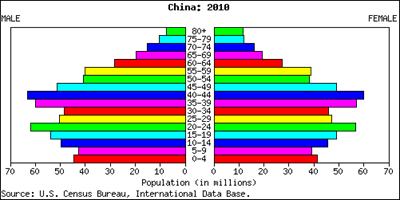

What are they talking about? This:

Note the low “base”: China’s population in the 0-15 age group is relatively smaller than the population in “older” working-age brackets. It used to be that China’s growth could depend on factor accumulation – more people added to more capital equals high growth, without necessarily adding productivity to the mix. That’s the growth dynamic that helped other East Asian countries enjoy super-sized growth rates for over 30-40 years.

But like Singapore and Korea and Taiwan, when you get past that demographic transition stage, growth slows down for the simple reason that labour force growth is slowing down. Thirty years down the road, China’s growth will slow even further to the low single digit stage, as the population begins to resemble that of Japan. If you can get 2%-3% growth under those circumstances, you’d be doing pretty well.

Malaysia is “lucky” in the sense that we haven’t gotten that far yet – in fact, despite being a middle-income country, we still have the demographic profile of a low income economy. But trend growth has slowed in the past decade, not so much because of crises or middle income traps, but simply because our labour force growth has also slowed, though not to the extent of our higher income neighbours.

Will China’s slowing growth momentum affect Malaysia? Absolutely, as our trade with China has grown leaps and bounds in the past ten years, to the point where China is now our number one trading partner.

China’s impact on the global economy has been profound and not always benign, from essentially capping inflation in goods prices (via low cost manufacturing), to being the underlying reason behind the commodity price boom, to artificially depressing long term interest rates (via recycling of international reserves), thus contributing to the Western world’s consumption and debt binge.

That role is evolving now, and you would expect to see all the above influences to start ebbing away. It’s been a great ride while it lasted, but its a brave new world we are entering now and old certainties will surely die away.

This comment has been removed by the author.

ReplyDeleteWe have our own brave new world -

ReplyDeleteforeign workers may be emboldened to ask for more when we apply a minimum wage ruling at a time when our export markets are down and therefore price-sensitive;

women make up more of the educated workforce but less of the science-technology pool needed to advance technical achievements that churn industrial growth, a challenge aggravated by poor command of english language needed for global services.

do you think the present government is remotely aware of these trends?

The boss pay is equivalent to 200 of his low end staff.And top mgmt well paid as well.And company is not exactly bleeding.

ReplyDeleteSo,wats wrong with imposing minimum pay..and reducing foreign labour quotas.?If govt cuts down on foreign labour even without minimum pay salaries will be higher.

And if labor cost becomes a drag;the creative owners who gets extra productivity via mechanisation/better systems will win.Isn't that a positive?

How many creative owners are there in Malaysia to pay bills when oil finishes and build high-income economy? Where are they right now? What has any done so far? How many patents have been commercialized? What have been the payouts? What is net capital inflow last month? Who are the geniuses in our midst? How do you make a piece of furniture for export?

ReplyDeleteJust questions.

Well if you do know the answer care to share...your questions do not mean malaysia is in a constant quandry...i mean..greece and iceland went bakrupt before us and Malaysia was suppose to went bakrupt tennyears ago,.haha...malaysia is still a big country with 28 million people...i may not be a patent holder but i know some of my friends regardless of races who have high potential to bring malaysia into higher gear and please do not forget our oil and gas employ and give scholarships to the brightest and smartest of our students in various fields..

ReplyDeletewe have been having 'highest potential' for a long time, no?

ReplyDeletereading your response, maybe the death certificate should be predated immediately.

let me ask another simple question- we were ahead of China in terms of industrialization and globalization. What are we exporting to China now?

Hehe i think walla stayed in advanced countries for way too long. Chill.. Rome was not built in a day. We are building a nation here.

ReplyDeleteLike Proton?

ReplyDeleteBuilding a nation starts with not evading simple questions because the answers will show whether the mind is focused or in denial.

Like (repost):

What are we exporting to China now?

now TRY.

Otherwise the only bricks to build our own Rome would be made of one component:

'chill'

What are we exporting to china.

ReplyDeleteSimple answers, palm pil, food and raw materials.

Despite china being the world's factory, malaysia is fortunately part of the supply chain kf priducts made in china.,..iphone camera modules are made in malaysia...apple have actually subcon the entire camera moduke for iphones to a EMS plant Bukit Raja, the Zhuhai plant in China that made the modlues have been sold , and Chinese semicon plants prefer to buy substrates and semicon chops from Malaysia because of our better quality(which makes ours cheaper) and not forgetting china is now have an expanding solar energy aganda and Malaysia happens to be one of the biggest manufacturer of solar wafsr and modules.

Who owns the cam module,chips,solar energy modules manufacturers?Do they pay tax?Did we provide them softloans n grants?Will they be angry if we rollback subsidies of gas n electricity?

ReplyDeleteSome of these companies are oem, so they will not likely roll the matt if the government pull thelugs on subsidies and closing down a plant will take years hence room for negotiations will be available.A typical wafer fab plant costs $1 billion, a substrate plant which makes the basic wafers cost hundreds of millkons of dollars..so shutting down plants is not like switching off tbe light..there will early warning signs and the government can negotiate

ReplyDeleteMalaysian glc have owmed some semicon plants, like silterra which makes chips and substartes which will ensure malaysian indusial base in the semicon industry is maintained.

I always see proton and local brands as an insurance againts flight of car manufacturers to cheaper regions, with the condition the government penalize local manufacturers should they relocate.

My 2 sen btw base on my own experience dealing in the semicon industry.just for information, hiring engineers and operators is cheaper than in china thanks to low inflatiob and lower cost of living.

Apologies, hiring engineers and kperators in malaysia is cheaper than in china due to our low inflation and cost of living

ReplyDeletehttp://is.gd/tw133B

ReplyDeletehttp://is.gd/FfGsC3

http://is.gd/npZeED

hisham,

ReplyDeletei read somewhere China rescaled growth projection signals a shift from export driven to consumption economy much like the US. Seems to me China is ready to shed its skin (this time for real) to become the second advanced high income superpower. Can two such nation coexist?

@anon 8.35

ReplyDeleteYes - remember the cold war? But this time it really will be different. The USSR and the US were economically distinct. But the economic ties between China and the US are far stronger. Even a redirection of China's economy towards domestic consumption won't change that. There's simply too many US companies deeply involved in China.