Last week’s Monetary Policy Committee statement made very clear that policy tightening of some sort or another is on the way (excerpt; emphasis added):

At the Monetary Policy Committee (MPC) meeting today, Bank Negara Malaysia decided to maintain the Overnight Policy Rate (OPR) at 3.00 percent.

Global growth moderated in the first quarter with several key economies affected by weather-related and policy-induced factors. Looking ahead, the global economy is expected to remain on a path of gradual recovery….

…For Malaysia, latest indicators suggest that the domestic economy continued to register favourable performance in the first quarter. Going forward, growth will remain anchored by domestic demand with additional support from the improved external environment….

…Inflation has stabilised in recent months amid the more favourable weather conditions and as the impact of the price adjustments for utilities and energy moderate. Going forward, inflation is, however, expected to remain above its long-run average due to the higher domestic cost factors.

Amid the firm growth prospects and inflation remaining above its long-run average, there are signs of the continued build-up of financial imbalances. While the macro and micro prudential measures have had a moderating impact on the growth of household indebtedness, the current monetary and financial conditions could lead to a broader build up in economic and financial imbalances. Going forward, the degree of monetary accommodation may need to be adjusted to ensure that the risks arising from the accumulation of these imbalances would not undermine the growth prospects of the Malaysian economy.

The key paragraph is the last one, with its ominous warning of “degree of monetary accommodation may need to be adjusted”. That’s about as clear a signal as can be given.

The thing is, I’m not sure its correct. A lot of the reports I’ve read over the past day or so talk about negative real interest rates and the drop off in deposit growth. But that sort of justification for monetary tightening is frankly confused. It’d be more correct to point to stronger growth this year, but few of the analysts I’ve read have adjusted their forecasts sufficiently higher. I think growth for 1Q2014 is going to be unusually strong, as much from a base effect (1Q2013 was terrible) as from the recent runup in exports.

But let me deal with the two narratives mentioned above first.

It’s absolutely true that the real interest rate is currently negative and a prolonged bout of negative real interest rates can be destabilising:

One thing to note here is that BNM often takes a more subtle view of the real interest rate – note that in the last tightening cycle, BNM stopped raising the OPR in the middle of a period of negative real interest rates.

In both periods, the acceleration in inflation has been policy driven – a series of one-time increases in subsidised prices, with what so far appears to be little pass through into other prices. The problem here is that a real interest rate derived from subtracting annual CPI growth under these circumstances would overstate the difference and the threat of excessive credit creation. These are isolated jumps in the price level, not a permanent increase in the slope of the CPI. Put another way, the increase in the CPI doesn’t signal a change in inflation expectations.

So let me propose an alternate measure:

Here, I’ve based the RIR calculation on the difference between the OPR and annualised monthly changes in the CPI (monthly growth in the CPI to the power of 12). Using the monthly measure instead of an annual growth calculation allows the RIR calculation to adjust faster to changes in the CPI, at the cost of introducing some noise to the process.

The first spike down in the RIR in 2013 was due to 20 sen petrol subsidy reduction, and it stayed down because of the removal of the sugar subsidy and hike in alcohol and tobacco excise duty. The second sharp spike (in Jan-14) was due to the rise in the electricity tariff. But the last data point we have shows inflation back to “normal” – the equivalent of an annualised rate of 1.0%, and well below Malaysia’s long term average of about 3%.

I strongly suspect that’s where it will more or less stay going forward i.e. absent the impact of further subsidy rationalisation, the RIR will stay positive. In fact, it will be overly positive. So the idea that “financial imbalances” are going to increase because the real interest rate is “negative” doesn’t really hold water. We’ll have a better idea after the April and May data come out, but I’d bet my RIR calculation would still be in over-tight territory.

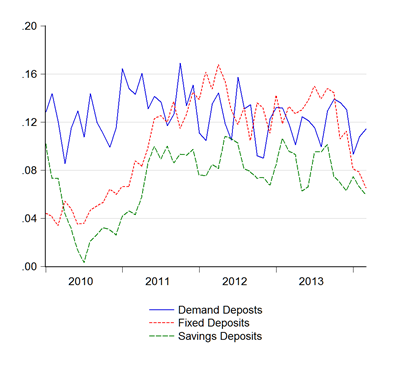

The second narrative, that interest rates should be increased to attract more deposits, is a sign of truly muddled thinking. The drop off in deposit growth is true enough (log annual changes):

But it’s largely confined to term deposit growth, not demand or savings deposits. To me, that’s not a sign of savers shying away from placing their money in banks because of negative rates; rather it looks like a reduction in money demand. That clearly stands out if you look at the longer series – term deposit growth tends to fall off when economic activity picks up.

It’s not hard to figure out why – as firms increase production and investment, they’ll utilise more of their cash for working and fixed capital. That implies a reduction in the average maturity of deposits i.e. less demand for term deposits and greater demand for demand deposits and money market/interbank placements. It’s the same dynamic that causes bond yield curves to steepen.

More to the point, both in theory and in practice, an increase in interest rates should result in slower, not faster, deposit growth. This would be true whether you believe that money is exogenous (deposits create loans) or endogenous (loans create deposits).

Let’s think about that for a minute. If money was exogenous, a tightening of policy would entail the central bank reducing the rate at which it creates high-powered money. This reduces the ability of banks to create loans and restricts the growth of the money supply and hence deposits. If money was endogenous instead, an increase in the cost of credit would reduce demand for loans, which in turn directly results in slower deposit creation. Either way, deposit growth slows when monetary policy is tightened.

To simplify thinking about this even more, let’s try a more concrete example. Say I own a portfolio of financial assets ranging from cash to stocks and bonds. With an interest rate rise, I shift some of my assets from stocks to bank deposits. Question – does this increase or reduce the amount of deposits in the financial system?

The answer is neither, because the conversion of some of my stocks to cash has to be facilitated by someone else simultaneously converting their cash to stock. Investment in stocks and bonds always involve offsetting transactions – that’s why they are transactions. My divestment must be matched by someone’s investment, otherwise there is no deal to close.

Insofar as there will be more people wanting to sell than to buy when interest rates rise, that should cause the price of stocks and bonds to fall to the point where buyers are matched with sellers. But this does not change the level of deposits in aggregate, only the price at which such transactions are conducted.

Thinking that aggregate deposit growth can be induced by an interest rate increase is a classic case of the fallacy of composition. The only way deposits would rise under an interest rate increase is if someone has previously been hiding their money under the mattress.

To push the point even further, I calculated the elasticity of both the level and growth in demand and term deposits with respect to the OPR under the current regime (July 2005 onwards). It turns out to be a big fat ZERO – changes in the OPR have no relationship with the level or growth of demand or term deposits. Under the previous policy regime (Sept 1998-July 2005), the elasticities were mildly negative i.e. an increase in interest rates caused deposit levels and growth to actually decline. Either way, an interest rate hike would either have a negative impact on deposit growth, or result in no impact at all.

To make a long story short, raising interest rates to “encourage” deposit growth has neither theoretical or empirical backing.

If there is a solid justification for tightening policy this year, it would be because of stronger growth and the positive output gap. As against that, much of this growth is against a low base, and other indicators such as loan growth are slowing.

What it boils down to is a judgement call. Just don’t base that judgement on pop theory.

No comments:

Post a Comment