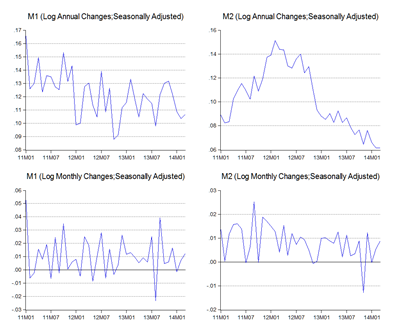

Monetary conditions in March appear to have tightened (log annual and monthly changes; seasonally adjusted):

M2 growth fell to 6.0% yoy, which is more than a little worrying – as a rule of thumb, you want to see money growth approximate real growth plus inflation. Having said that, real indicators have been pretty strong, and loan applications (demand) and especially approvals (supply) look decent; these imply that much of the drop off in money growth is coming from other components of M2.

Culprit number one, like last month, was cash which dropped off another RM300 million. Potential culprit number two is Fixed Deposits, where the rate of growth has dropped off steeply from the end of last year, largely mirroring the drop off in overall M2 growth. FX deposits on the other hand, have been rising steeply, thanks in no small part to BNM releasing FX liquidity into the market.

So, as of right now anyway, slower M2 growth isn’t really signalling a weakening growth momentum in the real economy.

On the interest rate front, there’s been some compression of spreads in the MGS market:

After a sharp steepening of the yield curve from September last year, things are starting to settle down again. Spreads are down 5-10bp in February and March.

At the really short end, so the same is happening in the interbank market:

However, liquidity is still gradually tightening:

…but I don’t expect that much of an impact on market interest rates. Papers are getting short in supply, what with the ongoing drop off in corporate issuance and the government’s fiscal consolidation.

Technical Notes

All data from the March 2014 Monthly Statistical Bulletin from Bank Negara Malaysia

No comments:

Post a Comment