It's taken me this long to really delve into last week's GDP report, largely because I wanted to try something different (results forthcoming). But before getting into that, the headline numbers themselves are mostly encouraging (log annual and quarterly SAAR changes):

RGDP rose +3.6% yoy (+29.1% qoq SAAR), while NGDP rose 12.1% yoy (+61.2% qoq SAAR (!)). Overall, the economy is close to regaining the pre-pandemic output trend (RM billions):DOSM has some spiffy charts to show which sectors and categories of spending are almost back.

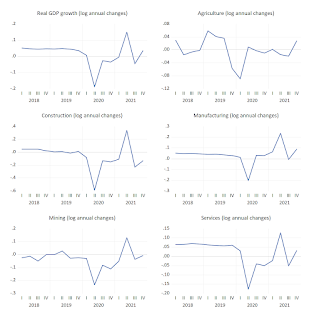

That's the good news. The bad news is that growth remains pretty narrow (log annual changes):

On the demand side, it's mainly coming from the external sector ie largely exports, which rose +13.3% yoy. On the supply side, it's manufacturing (+9.1% yoy) with some support from agriculture (+2.8%). Services is a mixed picture, but mainly boosted by government. The upshot is that the recovery is fairly narrow - really palm oil, downstream oil & gas, and semiconductors. The employment implications (and therefore spillover into the rest of the economy) I'd argue is limited.

On the demand side, it's mainly coming from the external sector ie largely exports, which rose +13.3% yoy. On the supply side, it's manufacturing (+9.1% yoy) with some support from agriculture (+2.8%). Services is a mixed picture, but mainly boosted by government. The upshot is that the recovery is fairly narrow - really palm oil, downstream oil & gas, and semiconductors. The employment implications (and therefore spillover into the rest of the economy) I'd argue is limited.

So the picture is one of economic healing, not one of full health. We're not quite there yet in terms of getting back to any economic norm, and bears out a K-shaped recovery scenario. Some sectors are doing very well, while others continue to really suffer. Although aggregate output is likely to come back to trend, I don't really expect to see broad based growth until we lift border restrictions.

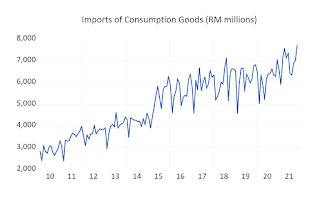

I'll cover some of the other interesting stuff arising from the GDP numbers tomorrow, but a slight and rather ugly digression. I was looking for any evidence that would support the removal of fiscal and monetary policy support, and came across this data (RM millions):

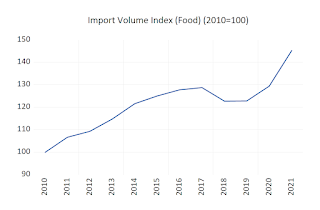

Excess demand doesn't only turn up as inflation, it could equally turn up as higher imports (I'll return to this subject in a future post). One possibility here is that import prices could be higher, thus raising the import numbers without necessarily raising import volumes. So I dug deeper, and found something really interesting (Index numbers, 2010=100):

The volume of food imports has risen +45.3% since 2010. I'm fairly sure that the population hasn't expanded by that much, and it certainly isn't possible for everyone to eat 45% more on average than ten years ago. The increase in the last two years alone was over 18%. The implication is that there's been a steady shortfall in domestic food production over the past decade. I'd note here that 2/3rds of the value of agricultural output in Malaysia is cash crops or logging.

Technical Notes:

GDP and trade indices data from DOSM

Salam Boss. On food imports, is it possible that it is caused by hoarding (buy now since it's taking too much time for those items to arrive), or maybe food importers had ordered those items way before all of the supply bottleneck problem came up, and it suddenly showed up at the port at one go? Or maybe because some other reasons that we might miss here?

ReplyDelete