This post is over two weeks late, but what with CNY and other news taking centre stage, plus because this post looks at conditions near two months ago, I think that’s a little allowable.

Money supply growth was mostly stable in December, though seasonally adjusted annual M2 growth slowed to 6.9% in log terms (log annual and monthly changes; seasonally adjusted):

This appears to be a seasonal effect that isn’t fully captured by the seasonal adjustment process, so I’d tend to pass it off as a recurring anomaly. In narrative terms, it’s not hard to find a reason for this really – better year-end bonuses means a pay down of consumer debt, which reduces the money supply…or at least slows it down.

Loan data lends some support to this conjecture (log annual and monthly changes):

Note that there’s a base effect in the annual growth figures – it looks high, but that’s because loan growth was much slower and below trend in 2009.

Interest rates and the debt markets of course provide more fruitful ground for analysis.

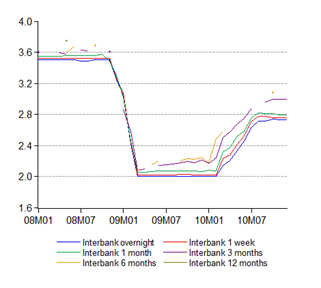

The interbank yield curve was fairly stable:

…as BNM maintained the OPR and trading settled down; interbank trading volumes were half the level they were during the first half of 2010.

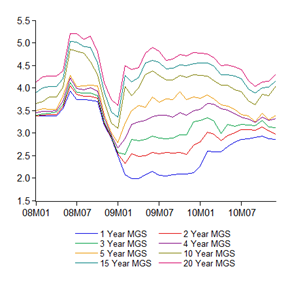

The MGS yield curve was a lot more interesting, especially given the impact it has on corporate debt:

The curve has steepened a lot at the long end over the past three months to December…heightened medium term inflation expectations? A side-effect of the Fed’s QE2?

It’s not due to issuance, as new supply was fairly meagre during those months, which would tend to put downward pressure on yields (RM millions):

Nor is it due very much to foreign selling, as foreign holdings of MGS and other Malaysian debt has held fairly steady, contrary to my expectations of some window dressing going into the new year (RM millions):

And you can’t blame market volume either (RM millions):

So it goes back to fundamentals – either there are rising expectations of higher inflation over the 5-10 year horizon, or there’s an expectation of incoming supply in those maturities (hint! hint!).

Which suggests that if you’re looking to borrow, now’s a good time – lock in rates at the current levels over the long term. With so many ETP projects expected to come onstream this year, not to mention the billions required for KL’s MRT project, yields are going to go up for the government and everybody else.

Rating agencies and other market participants are expecting record Ringgit bond issuance in 2011, not just from new borrowings, but also to roll over existing debt. I’m not going to go so far as to call a bear market in Malaysian bonds for 2011, but some upwards pressure on yields should be a given.

Technical Notes:

All data are from BNM’s December 2010 Monthly Statistical Bulletin

No comments:

Post a Comment