With the change in weights and base years that DOS made with the CPI, I took the opportunity to completely revamp the splicing and weighting procedures I’ve been using previously. I’d been using a mixture of arithmetic and geometric averaging to arrive at index numbers for the component and composite indices; now its all based on geometric averaging…which took some doing. That, some minor error correction, and the complications from having to generate intermediate indexes for splicing, is why this analysis arrives so late.

First a word about the change in weights – DOS tweaks the weightage for each consumption category every five years, based on household expenditure surveys. That means you can use the weights to provide a snapshot of what the median Malaysian household actually spends on (click on the graph for a larger version):

I’ve kept here the same categories used for the 2000 base year for comparisons sake. The notable changes over the past decade include a gradual decline in purchases of food and furnishings (as a portion of household expenditure), a gradual increase in outlays for transportation and communication, and a dramatic increase in spending on recreation, education and tourism.

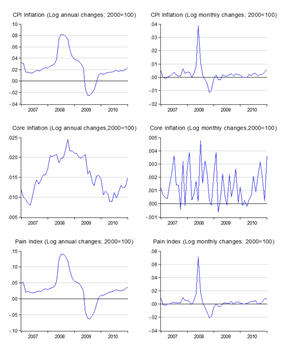

Does the change in weights have much impact on headline inflation? Not really – the weight change caused a measurement difference of around 0.1%-0.2% higher as of December 2010. Considering the increase in petrol costs in December, that bump up was relatively minor (log annual and monthly changes):

Annual CPI inflation reached 2.4% in log terms in January, and the Pain index, which measures food and fuel costs, increased 3.8%. The monthly log increases are the highest readings since July 2008, when the government cut subsidies drastically in the face of US$140 oil. More importantly, core inflation (inflation ex-food, ex-transport) accelerated to near 1.5% in log terms in January, which means that right now it’s already a little over its long-term trend, even if overall headline inflation remains below it.

So far what we’re looking at is cost-push inflation, which generally doesn’t warrant a monetary response from BNM. The turmoil in the Middle East and especially North Africa, bad weather affecting harvests, and fast emerging market growth have all been factors pushing up food and commodity prices lately. But these should be taken as temporary cyclical aberrations to normal market conditions. The global weather cycle is turning, and both China and India (among others) have taken steps to cool their economies. Libya’s a bit of a wildcard which could lead to a permanently higher global oil price equilibrium, but that’s a one-time shock not an on-going factor pushing up oil prices. The stronger Ringgit has also helped in mitigating domestic price pressures.

Having said that, we’re getting ever closer to the point where inflation – cost push or otherwise – passes BNM’s tolerance threshold. The consensus opinion is that we’ll see a round of interest rate hikes starting in the second half of the year – that’s not a bad prediction to bet on. My feeling is that BNM will probably wait until we’ve had a couple more months of higher inflation readings before it moves, which puts the earliest date at which we could expect a change in the official policy rate would be in April/May.

Technical Notes:

January 2011 Consumer Price Index report from the Department of Statistics

No comments:

Post a Comment