It's taken me this long to really delve into last week's GDP report, largely because I wanted to try something different (results forthcoming). But before getting into that, the headline numbers themselves are mostly encouraging (log annual and quarterly SAAR changes):

Wednesday, February 16, 2022

Thursday, February 15, 2018

4Q17 GDP: Momentum Slowing

A quick note on yesterday’s GDP report. The date brought the growth numbers for 2017 to a gratifyingly satisfying conclusion (log annual change and annualised seasonally adjusted quarterly change; 2010 constant prices):

GDP expanded at a 5.8% clip (in log terms; 5.9% in percentage terms), just a little lower than the 6.1% log change seen in 3Q17. That brings full year growth to 5.7% (log) and 5.9% (percentage), the best performance since 2014.

Thursday, September 14, 2017

Housing, Inflation and the Cost of Living

I came across a couple of really good articles over the last couple of days on the subject of housing, inflation and GDP that I wanted to share (jump to the end for a summary of both articles).

First, the treatment of housing in the construction of the Consumer Price Index, which is commonly used to measure inflation (excerpt):

Headline inflation measures shouldn’t ignore costs of home ownership

Mojmir Hampl, Tomas Havranek 12 September 2017Statistical offices of many countries measure the costs of home ownership by computing imputed rents, which are then included in headline inflation measures. This is the case for the US, Japan, and Switzerland, among others. In contrast, the harmonised index of consumer prices (HICP) – the EU’s most important inflation statistic – excludes owner-occupied housing, for the technical reason that imputed transactions are inconsistent with the definition of the HICP, and a more complex approach based on net acquisitions would be required (Eurostat 2012, 2013).….

…Because house purchases involve a substantial investment component, their inclusion in headline inflation makes many statisticians uneasy. Conceptually, however, homes are a special case of durable goods, because they provide a claim on a stream of future services. Cecchetti (2007), for example, showed the long-term capital gain from home ownership is very small….

Wednesday, September 6, 2017

Guys, This Argument Is A Total Waste Of Time

YB Rafizi Ramli is claiming that income tax collection has exceeded the rate of growth of the economy (excerpt, emphasis added):

…Maknanya, dalam tahun 2017 ini pentadbiran Dato’ Seri Najib dijangka akan mengutip hampir sekali ganda lebih banyak cukai pendapatan (pada jumlah RM112 bilion) berbanding kutipan tujuh tahun lalu iaitu 2010 semasa beliau mula-mula menjadi Perdana Menteri (pada jumlah RM60.3 bilion).

Malah, kenaikan purata tahunan sepanjang tempoh 2010 ke 2017 (disebut cumulative annual growth rate atau CAGR) adalah 11%, iaitu kadar bertambahnya kutipan cukai tahunan secara purata di antara 2010 ke 2017 sebanyak 11% setiap tahun….

…1. Pertumbuhan ekonomi negara hanyalah sekitar 5% sahaja dalam tempoh yang sama. Jika ekonomi tumbuh hanya 5%, maknanya rakyat tidak merasa kenaikan gaji yang mendadak dan peniaga juga tidak merasa keuntungan yang mendadak yang membolehkan LHDN mengutip cukai yang lebih tinggi

Monday, November 14, 2016

4 Thoughts for the Week

GDP Report

Surprisingly strong at 4.3% yoy…or may be not. Iwas expecting a pickup as we had the minimum wage revision, civil service pay revision, cut in the OPR and cut in the EPF contribution rate. The end result was a 6% (qoq SAAR), which is the best quarterly growth rate since 4Q2014. I haven’t delved into the details yet (the bond market tantrum is occupying my working hour attention at the moment), but apparently there was a pretty decent growth contribution from external trade as well.

Wednesday, July 13, 2016

Borrowing GDP

First of all, Selamat Hari Raya, Maaf Zahir dan Batin to all. I’m back from my annual Ramadhan break, and fully determined to blog more regularly from now on.

An interesting data release yesterday has the economics profession completely bemused – Ireland has just restated their 2015 GDP growth to 26.3% (!) from an initial estimate of 7.8% (excerpt):

Ireland’s Economists Left Speechless by 26% Growth Figure

In three days, Jim Power is due in London to brief the British-Irish Trade Association on the state of the Irish economy. Now, he has no idea what he is going to say.

The economy grew 26 percent in 2015, officials from the Central Statistics Office told a stunned room full of economists and reporters in Dublin on Tuesday. Previously, they had estimated growth of 7.8 percent.

Tuesday, May 10, 2016

To GDP Or Not To GDP

Quick one, highlighting a few articles on whether GDP remains an appropriate measure for human welfare.

First from Sir Charles Bean (excerpt):

...One particular challenge for economic measurement stems from the fact that an increasing share of consumption comprises digital products delivered at a zero price or funded through alternative means, such as advertising. While free virtual goods clearly have value to consumers, they are entirely excluded from GDP, in accordance with internationally accepted statistical standards. As a result, our measurements may not be capturing a growing share of economic activity....

Monday, November 16, 2015

3Q 2015 GDP: Flip A Coin

Last week’s GDP report was a mixed bag. On the one hand it paints a picture of an economy slowing down, especially in terms of domestic demand. On the other hand, some of the indicators appear to have bottomed out.

The headline numbers aren’t appealing (log annual and SAAR quarterly changes; 2010=100):

Wednesday, November 11, 2015

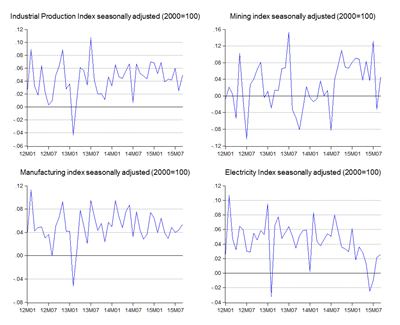

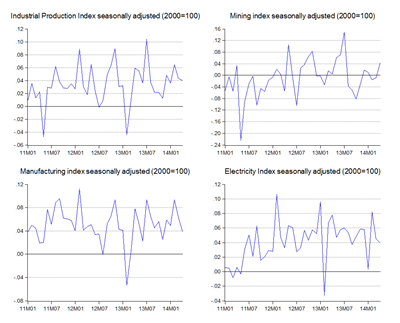

September 2015 IPI: Steady Recovery

Monday’s industrial production figures paint a picture of recovery (log annual and monthly changes; seasonally adjusted; 2000=100):

Manufacturing output has been steady for most of the year, but mining output (read: oil & gas) had been on a downtrend. More worrying to me was the sharp drop off in electricity generation – that pointed to underlying weakness in both business and consumer demand. Unless this was a dead cat bounce, September’s figures suggests whatever malaise hitting both sectors is now over.

Tuesday, July 21, 2015

Assessing July

I’m back from my usual Ramadhan blogging break, and my, aren’t there lots of things to comment on. This will be a kind of omnibus blog post, covering some of the developments over the past month.

2Q2015 GDP Growth

A funny thing happened with the change in national accounts base year to 2010 – the economy all of a sudden got a lot harder to forecast. The usual indicators no longer seem to matter as much – for example, MIER’s confidence indices appear to have totally decoupled from GDP – which makes forecasting growth more than a little bit more difficult. IPI and trade remain good predictors, but their standard deviations have doubled and the forecasts are suggesting two completely different pictures of the economy.

Thursday, May 21, 2015

1Q2015 GDP: Something Wicked This Way Comes

I haven’t had much of a chance to write this week, with various things on my calendar (I’ll have some thoughts on the 11MP tomorrow, along with the April CPI). But I wanted to very quickly touch on last week’s GDP report.

The published numbers look pretty good (log annual and seasonally adjusted quarterly changes; 2010=100):

Wednesday, May 6, 2015

Social Progress

Michael Porter on social progress (excerpt):

Economic growth has lifted hundreds of millions of people out of poverty and improved the lives of many more over the last half-century. Yet it is increasingly evident that a model of human development based on economic progress alone is incomplete. A society which fails to address basic human needs, equip citizens to improve their quality of life, protect the environment, and provide opportunity for many of its citizens is not succeeding. Inclusive growth requires both economic and social progress.

Monday, February 16, 2015

4Q2014 National Accounts: Smokin’ Hot

From last week’s 4Q2014 GDP report, it looks like the IPI was more than just a harbinger, it was spot on (log annual and quarterly SAAR changes; 2005=100):

Wednesday, November 19, 2014

3Q2014 GDP: Momentum Slowing

I’m still torn. Last week’s GDP report was a little better than I thought, but might just be the best growth we’re going to see for a while (log annual and SAAR changes):

Note that while annual growth is holding up pretty well, quarterly growth in 3Q2014 is actually the weakest in nearly two years. There’s little in either the global or domestic economy to suggest that growth will get any better over the short term.

Thursday, November 13, 2014

3Q2014 GDP Preview

I’m torn. Despite all the weak numbers over the past three months, all my forecasting models say real GDP growth will still be above 5%, and in most cases, above 6%, for 3Q2014 (log annual changes):

The IPI based forecast is probably the most bearish, and it still says we’ll be above 5% – my other models are far more bullish. The forecasts for 4Q2014 are weaker, but not unusually so. The generated forecasts for next year cluster a little above 5% growth, which is about right for the Malaysian economy.

Friday, September 12, 2014

July 2014 Industrial Production: A Bad Start To 3Q2014

Monday, August 18, 2014

2Q2014 GDP: Into Orbit

My, oh my, how things have changed (log annual and quarterly SAAR changes; 2005=100):

We ain’t talkin’ bout no base effect no more. T’ain’t bout prices neither. At 6.4% in percentage terms, the economy has put up a pretty solid growth number. If the low level of output in 1Q2013 influenced growth this year, that’s less of a consideration for 2Q2014. And if export and commodity prices trended up in 1Q2014, they’ve been flat or trending down in 2Q2014 (log annual and quarterly SAAR changes; 2005=100):

Monday, August 4, 2014

Data Releases for July 2014

I’m back from my usual Ramadhan blogging sabbatical. It’s been a bittersweet month – the economy is chugging along better than I ever hoped for and the German demolition of Brazil in the World Cup semifinals was a hoot to watch, but then there was the staggering blow of the MH17 tragedy and the incomprehensible Israeli invasion of the Gaza strip on the very same day. Geo-political risks appear to be increasing, while the global economy remains on a fragile footing, the US recovery notwithstanding.

Thursday, June 12, 2014

April 2014 Industrial Production: Steady As She Goes

The numbers aren't as spiffy as the out-of-this-world export growth numbers, but they’re pretty respectable (log annual and monthly changes; seasonally adjusted):

Industrial output rose by 4.0%, coming off last month’s 4.3% in log terms, with a pickup in mining helping to offset a pullback in manufacturing and electricity production.

Monday, May 19, 2014

My Rant Of The Day: Misusing The Word “Print”

The last few months I’ve been forced into reading a lot of analyst reports. While for the most part it’s been worthwhile in terms of gauging what other people are thinking, there’s something about these reports that just bugs the hell out of me.

And that is the use – or rather, misuse – of the word “print”.

This isn’t even a problem just with our local guys either, I see the word often used by foreign bank and broker analysts as well. As in, “the latest GDP print” or “compared to the 4Q2013 BOP print”.

From the context, these guys are using the word “print” as synonymous with “record” or “report”. But in English, “print” doesn’t carry the same meaning, connotation or usage as the latter two words. To me, a “print” is a reproduction of something, not the thing itself.

So when people refer to a report as a “print”, I have visions of them queuing up to get reports as they’re published, and fastidiously making reference to their own individual copies while writing out their commentaries. Since this isn’t what anybody actually does, referring to economic data as coming from a “print” makes me cringe. It’s as if the form of a report (a publication) is more important than the data it conveys (the actual numbers).

Here’s the link to the Merriam-Webster definition, and here’s the link for the Oxford Dictionaries definition.

Nowhere in those definitions is “print” used in a way that could denote a report or the content of a report – only the process by which it is made (verb) or the form it can take (noun). The image that I usually carry in my head, when using “print” as a noun, is the same definition used by New York’s Museum of Modern Art:

“A print is a work of art made up of ink on paper and existing in multiple examples. It is created not by drawing directly on paper , but through an indirect transfer process.”

The stuff I have hanging on my office wall are prints. The data and reports issued by national statistical authorities are NOT prints.

Unless you happen to think these are works of art.