It’s no secret that capital has been leaving the country, even as the trade balance generates a continuous surplus. Breaking down the financial account of the balance of payments (BOP), here’s what Malaysia has experienced over the past ten years or so (1999-2008, RM Millions):

While FDI has been increasing, it doesn’t even begin to cover outward investment or the (negative) “other” investment. Portfolio investment has ebbed and flowed depending on the vagaries of the stock market, except for last year with a flight to safety from all emerging markets prompting a sell down of equities and other assets in favour of (paradoxically) USD assets. That spike has partially reversed in 2009.

The cumulative numbers are staggering: negative RM156.6 billion in outward direct investment, RM257.0 billion in other investment, and RM52.8 billion in portfolio investment, for a total outflow as at end of 2008 of RM 466.5 billion.

That’s right, nearly half a trillion Ringgit, or half of current M3.

The question is: is this outward flow occurring because foreigners are abandoning Malaysia as an investment destination, or is this Malaysian companies investing abroad? The former is downright bad for obvious reasons, while the latter is only somewhat good as it can be counterbalanced by subsequent inward income flows. Anecdotal evidence favours the latter, as there’s plenty of news of domestic corporations making big bets on other emerging markets – such as Maybank in Indonesia, and Maxis in India.

However, there is an inherent flaw in using BOP data to figure out where investment is actually going, because it is a

flow measurement, not a

stock measurement. With BOP data, we’re completely ignoring the possibility of

reinvestment of profits and earnings. This doesn’t turn up in financial flows, and it’s difficult to judge private sector investment attitudes towards Malaysia based on BOP data alone.

It is more than possible that the outward flow of investment is due not only to Malaysian firms investing overseas, but also to foreign-owned firms redirecting investment overseas from retained profits generated locally. That in itself is not great news, but it’s certainly more palatable than foreign firms pulling up stakes and leaving. What we need is to get a view of foreign and domestic holdings of

investment stock, not just flows as in the BOP, to get a better idea of what’s going on.

Luckily, we do actually have such a report – the

International Investment Position. This is a relatively new set of statistical information (as such things go), and data availability is still very patchy for many countries. Malaysia’s for instance, only goes back to 2001 and was first published in 2005. Prior to the IIP, figuring out a country’s investment stock position (more commonly known as the net foreign asset position) was a matter of guesstimation and to be honest it still is, even with the IIP – you’re depending on accurate reporting to compile the statistics and there are many offshore money centers, some with dubious legal enforcement.

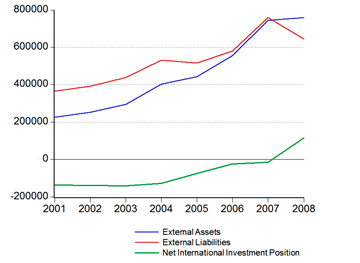

Be that as it may, the IIP makes for interesting reading. I’ve posted on Malaysia’s net foreign asset position, and the IIP (with some discrepancies) confirms the notion that Malaysia is now a net creditor nation (RM Millions):

Since we’re at the moment interested in the direct investment position, here’s both the asset and liabilities side (RM millions):

External Direct Investment Assets

External Direct Investment Liabilities

So we

are primarily looking at Malaysians investing abroad, with a very small pullback in foreign inward investment in 2008, which is understandable given economic conditions over the past two years. The numbers don’t quite reconcile with the BOP data, mainly due to slightly different categorization as well as the element of reinvested earnings involved.

And of course, the net portfolio position is still sharply negative (RM millions):

But on the whole, we’re in a better than decent position here (assuming the positive IIP holds). Even though investment and capital are leaving the country, this is counterbalanced by an increase in future potential earnings from abroad, as well as less pressure to keep reserves high. This also puts upward pressure on the exchange rate.

Technical Notes1. BOP data from BNM's

Monthly Statistical Bulletin2. The

International Investment Position Reports available from DOS