Caught this yesterday (excerpt):

Selangor, Penang tax hike woes

ONE part of Pakatan Harapan's manifesto covers cost of living and taxes, and points fingers at federal government policy.

If they are serious about reducing the cost of living and taxes, they should first look at Selangor and Penang.

On Dec 26, the Selangor Mentri Besar's Office scrambled to respond to my assertion that property-related taxes are the main cause of increase in cost of living in Selangor.

Datuk Seri Azmin Ali refused to accept my assertion and blamed Putrajaya and the goods and services tax (GST) for the increase….

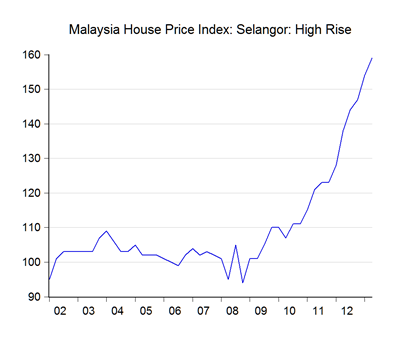

…There was a significant increase in cost of living between 2008 and 2011, years before the implementation of GST.

Moreover, the initiatives rolled out in 2016 by the state government were focused on rural residents. The MB's Office said several hundred thousand owners of kampung houses were given exemption on assessments.

But what about urban residents in the cities and towns where over 80% of Selangoreans reside?

The residents in apartments and urban dwellings have had to pay higher quit rent and assessment taxes since 2008?

This is where most of the increase in cost of living happens.

Most Selangor residents live in cities and towns and have been significantly affected by the rapid rise in property prices and rental because of the state government's policy.

I’m not going to play politics here. Property related taxes have increased across most states, and in my opinion probably a bigger factor in the increased cost of living than anything else. We can all argue over who is at fault, but ultimately, nothing much will change unless fundamental reforms are carried out.