Over the Raya holidays, I’ve taken a short break from blogging – family and getting back to work commitments has meant limited time or energy for looking at the economic situation. Plus it’s the start of football season (no, not

this type of football, I mean

this one - I’m actually watching the Monday Night Football stream right now) so there’s been plenty of distractions the past couple of weeks. But there’s some interesting developments going on and there’s the run up to the tabling of the Budget at the end of this month, which means I’ll hopefully be posting pretty frequently from now on.

But talking about Raya holidays provides a nice segue into what the numbers will say about the economy in August and September. I’ve been harping about seasonal adjustments a great deal in this blog, and holidays are a great example of how differing work/holiday conditions impact economic output. In other words, don’t be surprised if the numbers appear to have turned down the last couple of months – I don’t think I was the only one to take a break off from work or slowed down during fasting month. Looking at the August numbers appears to bear this out.

First, BNM always increases the currency in circulation just prior to Hari Raya and Chinese New Year – no prizes for guessing why. You’d therefore expect to see a jump in money supply figures around those times but especially in M1, as is the case this August (log annual and log monthly changes):

Based on what I’ve described, I wouldn’t ordinarily put too much weight on this increase in monetary aggregates as signaling further monetary easing by BNM or as an autonomous jump in financial activity. There is one interesting anomaly however, with foreign currency deposits in the banking system jumping by RM8.6 billion in August, which is about 2/3rds of the increase in M2:

There’s no obvious reason that I can find for the increase, as neither the stock market nor the Ringgit budged very much in August. International reserves are also up, so BNM has obviously taken some steps to drain forex deposits from the system (log monthly changes in international reserves):

…but that leaves the increase in the banking system unexplained. I’m not sure at this stage whether I want to speculate as to why.

Moving on, loan growth has decelerated (log monthly changes):

…but as I said, this is probably more a function of getting into fasting month and what it entails for output. To underscore what I mean, here’s the loan growth data for working capital and credit cards (log monthly changes):

Since there is an expected drop in output, loan demand from businesses will fall and there will be a corresponding increase in consumption. No surprises here. The corollary is that the opposite should occur after Hari Raya (or Chinese New Year), in other words a drop (or deceleration) in monetary aggregates, increase in business demand for loans, while consumption loans drop.

Now you may ask why I don’t just seasonally adjust the figures in this case, as I’ve done previously? If you haven’t the time or inclination to apply seasonal adjustments (as I

explained here) but still want to eyeball the data yourself, it pays to keep potential seasonal factors in mind. Another issue is that seasonal adjustments as applied to Malaysian data are a bit problematical because neither Hari Raya nor Chinese New Year is based on the solar calendar. That means the “seasonal effect” doesn’t occur in the same period every year, which makes statistical treatment a little difficult. Knowing how the numbers react during particular periods therefore helps analysis.

Having said that, seasonally adjusting the numbers doesn’t change the viewpoint very much:

M1 (log monthly changes): Loan Growth (log monthly changes):

Loan Growth (log monthly changes):

On the interest rate front, lending rates have continued to drift lower – which as far as I’m concerned is good news. What I find interesting is that the lending margin has drifted below the 3% level previously identified as being required for banks to survive an increase in NPLs while maintaining profitability (see

this post for details):

This is probably a function of NPLs not actually rising very much during this downturn, which means that banks could be more comfortable competing on price without jeopardizing their capital base at a time when loan demand is softening:

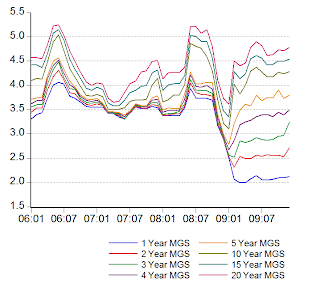

The only other interest rate story of interest (pardon the pun), is in MGS:

Note the flattening of the yield curve at the long end – yields for 10-20-year MGS have dropped between 20bp-30bp in the July-August timeframe, and another 5bp or so in September. Looking back, I think that uncertainty over the public borrowing requirement a few months back really drove prices down. What we’re seeing now is a calmer market, especially since there’s now little support (or requirement) for a third stimulus package and noises from the government about fiscal consolidation in operational expenditure.