This post is seriously late, as I’ve just switched laptops and my editing software is being cantankerous. However, the NEER and REER page has been updated, as has the Google Docs version.

Summary

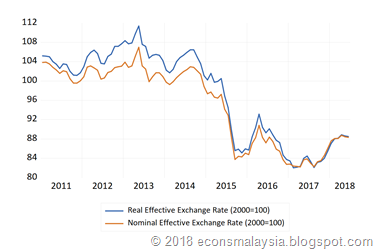

Despite the moves in the bilateral USDMYR exchange rate, there has been almost no movement in either the NEER and REER since February. This also applied to the narrow and ASEAN indexes as well. In other words, almost all the currency volatility of the past six months has been due to USD movements, with very little coming from other currencies. The nominal broad index was up 5.30% yoy, but just -0.15% on the month (REER: 4.78%, -0.15%).

Breaking down on a bilateral basis, movements were predictably mixed, with the Ringgit roughly up against half the basket and down on the other half. On a cumulative three month basis, the MYR has gained the most against the EUR (+3.15%), the GBP (+2.68%), the INR (+1.78%), the THB (+1.45%), and the AUD (+1.15%). The biggest losses were against the USD bloc countries in the basket, I.e. the USD (-2.35%), the HKD (-2.28%), and the VND (-2.18%).

Changelog:

- Indexes have been updated to June 2018

- CPI deflators and forecasts have been updated for May/June 2018

- Trade weights were updated to March 2018. This required revisions to all the indexes from Jan-18 onwards