The Government has had an outbreak of common sense (excerpt):

Hasan Malek: No more RON95 petrol, diesel subsidies from Dec 1

PUTRAJAYA: All subsidies for RON95 petrol and diesel will be stopped beginning Dec 1, said Datuk Hasan Malek.

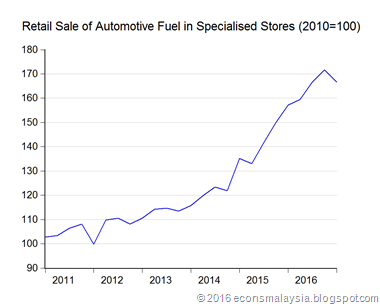

The Domestic Trade, Cooperatives and Consumerism Minister, who announced this at a press conference here on Friday, said the retail prices for RON95 petrol and diesel will be fixed according to a managed float, similar to the mechanism dictating the RON97 petrol price.

Hasan said there would be an announcement at the end of each month to set the following month's fuel prices.

He said it would be determined based on a monthly average price….

There’s still the super-subsidy on diesel (for public transport and fishermen) and subsidies on natural gas (which are huge), but the latter has been starting to be phased out as well. The gas subsidy in particular has been prone to abuse, with businesses using gas cylinders intended for households.

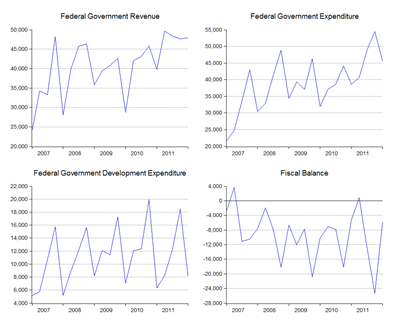

In any case, we’re well rid of the dangerously complicated multi-income-tier subsidy idea that the government has been mulling over. With global oil prices so low – for November, it appears that consumers have actually been paying a small tax on petrol – there would have been no better time for this move to have been made. We had that opportunity once in 2009-2010, and missed the chance. I’m happy it wasn’t missed this time.

If global oil prices stay low, and this is the scenario market participants are looking at at least for the next couple of years, then well and good. If prices move back up, then the government will no longer have to bear the cost of subsidising petrol and diesel, and use the increase in revenue on something more important – like public transport for instance, or education, or *gasp* paying down debt.

Having said that, we’re still not home free. Prices going forward will still fall under the Automatic Pricing Mechanism, which means profit margins are guaranteed for distribution and retailing. Oil retailers in Malaysia have been used to competing on a non-price basis; that’s not necessarily the optimum for consumer welfare. The next step should be to free up the market, and let the oil companies compete on price. That should give back to consumers some of the welfare loss associated with being exposed to global oil price volatility, essentially sharing some of the risk with producers.

I know, I’m asking for the sky. Still, I’m pretty happy with the decision today. It’s been a very long journey over the last five years.