One common complaint from just about everyone is that economic data comes out at a fairly big lag. Malaysian quarterly GDP reports typically come out two months after the fact, which makes informed decision making difficult at best. I've laid out some of the reasons for the lag in

this post here.

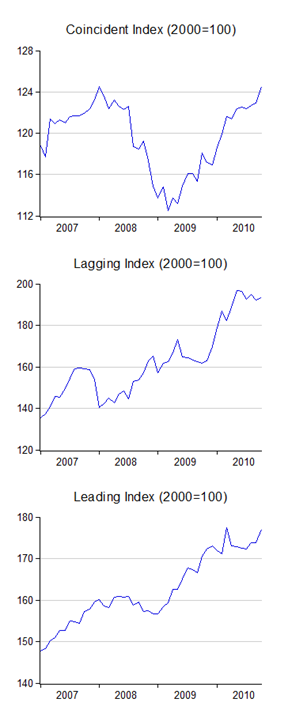

There are however some indicators that can give you a fairly accurate representation of what the economy is doing at much faster frequencies. The Department of Statistics issues monthly composite indexes that do exactly that. The Lagging Index is supposed to affirm the trajectory of the economy after the fact, the Coincident Index shows what the economy is doing right now, while the Leading Index gives an idea of how the economy will do in the future about 1 or 2 quarters ahead.

Here's what the indexes are showing up to February 2009:

All the Indexes are turning up, which gives some comfort that things are turning around. But how good really are these indexes relative to actual economic performance? The answer is: except for the Lagging Index surprisingly good.

I evaluated all three against real GDP (sample range 2005:1 to 2008:4), using both seasonal adjustment (x11) and with seasonal dummies. The quarterly index numbers are arrived at by averaging the monthly index numbers.

Only the Lagging Index didn't fit at all well. In terms of forecasting, the Coincident Index fit well

in-sample but not forecasting

out of sample (charts and results shown are for the non-seasonally adjusted regressions):

In-Sample Forecast (2005:1 to 2008:4):

LOG(RGDP_2005) = -0.63*LOG(IND_COIN) + 2.38*LOG(IND_COIN(-1)) + 3.36 + 0.01*D2 + 0.04*D3 + 0.03*D4

Out of Sample Forecast (2005:1 to 2007:4; dynamic forecast to 2009:1):

LOG(RGDP_2005) = 1.6729687*LOG(IND_COIN) + 3.69 + 0.01*D2 + 0.04*D3 + 0.04*D4

The Leading Index on the other hand is remarkably accurate:

In-Sample Forecast (2005:1 to 2008:4):

LOG(RGDP_2005) = 1.01*LOG(IND_LEAD) + 6.67 + 0.01*D2 + 0.04*D3 + 0.03*D4

Out of Sample Forecast (2005:1 to 2007:4; dynamic forecast to 2009:1):

LOG(RGDP_2005) = 1.02*LOG(IND_LEAD) + 6.63 + 0.01*D2 + 0.03*D3 + 0.03*D4

I admit to being surprised by these results. I would've thought the Lagging Index to be most accurate, and the Leading Index the least accurate - it turns out the opposite is true. The forecast standard error for the Leading Index is actually half that of the Coincident Index. I'd caution however that the above analysis is based on a rather short sample (reminder to self: a trip to DOS seems warranted). I'd love to know the exact composition of the Indexes and the source data - cointegration analysis would give a good idea of short term dynamics, as well as the relative importance of each component.

What does the Leading Index forecast say about 2009:1Q GDP? Based on the full sample:

Point forecast: RM128,236.1

Upper Bound: RM130,497.9

Lower Bound: RM125,974.4

The point forecast is equivalent to -0.7% growth y-o-y, and -9.5% growth q-o-q annualised, both down from 4Q 2008 growth but rather better than I expected. We'll see how accurate this is when the 1Q 2009 report comes out at the end of this month.