It's taken me this long to really delve into last week's GDP report, largely because I wanted to try something different (results forthcoming). But before getting into that, the headline numbers themselves are mostly encouraging (log annual and quarterly SAAR changes):

Wednesday, February 16, 2022

Monday, November 16, 2015

3Q 2015 GDP: Flip A Coin

Last week’s GDP report was a mixed bag. On the one hand it paints a picture of an economy slowing down, especially in terms of domestic demand. On the other hand, some of the indicators appear to have bottomed out.

The headline numbers aren’t appealing (log annual and SAAR quarterly changes; 2010=100):

Wednesday, November 11, 2015

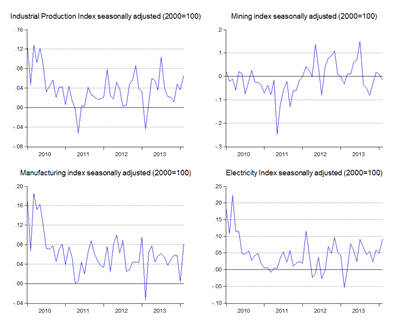

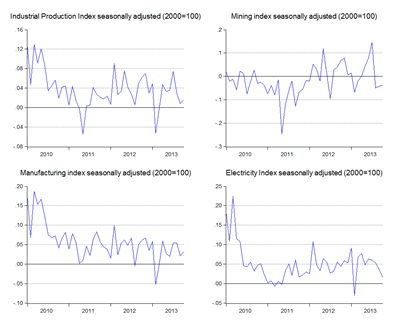

September 2015 IPI: Steady Recovery

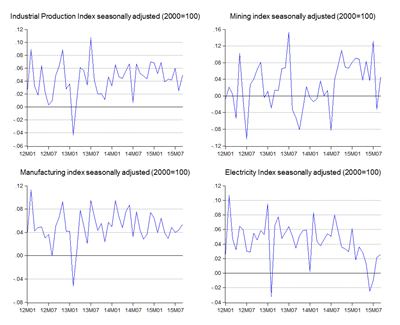

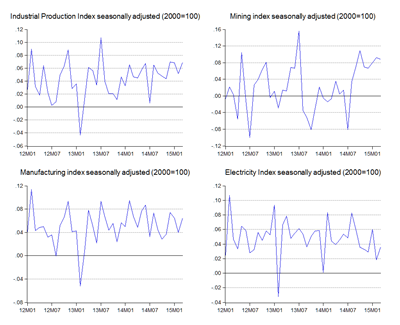

Monday’s industrial production figures paint a picture of recovery (log annual and monthly changes; seasonally adjusted; 2000=100):

Manufacturing output has been steady for most of the year, but mining output (read: oil & gas) had been on a downtrend. More worrying to me was the sharp drop off in electricity generation – that pointed to underlying weakness in both business and consumer demand. Unless this was a dead cat bounce, September’s figures suggests whatever malaise hitting both sectors is now over.

Tuesday, May 12, 2015

March 2015 Industrial Production

Monday, February 16, 2015

4Q2014 National Accounts: Smokin’ Hot

From last week’s 4Q2014 GDP report, it looks like the IPI was more than just a harbinger, it was spot on (log annual and quarterly SAAR changes; 2005=100):

Thursday, February 12, 2015

Dec 2014 Industrial Production: Smokin’

Back in 2011, I remember the budget coming out and the complete disbelief at the government’s 2012 growth forecast. From economists to the man on the street, nobody thought growth would be anywhere near 5%, much less exceed it (this was right after the Greek bailout). Hell, I was wrong too – I thought 5% was achievable, but a little on the optimistic side. In the end, the economy hit 5.6% GDP growth for 2012, almost right in the middle of the government’s initial forecast.

Deja Vu.

Tuesday, January 13, 2015

Nov 2014 Industrial Production

Last week’s industrial production numbers points to a still resilient domestic economy (log annual and monthly changes; seasonally adjusted):

Wednesday, November 19, 2014

3Q2014 GDP: Momentum Slowing

I’m still torn. Last week’s GDP report was a little better than I thought, but might just be the best growth we’re going to see for a while (log annual and SAAR changes):

Note that while annual growth is holding up pretty well, quarterly growth in 3Q2014 is actually the weakest in nearly two years. There’s little in either the global or domestic economy to suggest that growth will get any better over the short term.

Friday, September 12, 2014

July 2014 Industrial Production: A Bad Start To 3Q2014

Monday, August 18, 2014

2Q2014 GDP: Into Orbit

My, oh my, how things have changed (log annual and quarterly SAAR changes; 2005=100):

We ain’t talkin’ bout no base effect no more. T’ain’t bout prices neither. At 6.4% in percentage terms, the economy has put up a pretty solid growth number. If the low level of output in 1Q2013 influenced growth this year, that’s less of a consideration for 2Q2014. And if export and commodity prices trended up in 1Q2014, they’ve been flat or trending down in 2Q2014 (log annual and quarterly SAAR changes; 2005=100):

Tuesday, August 12, 2014

June 2014 Industrial Production: Hold On To Your Hats, Folks!

Monday, August 4, 2014

Data Releases for July 2014

I’m back from my usual Ramadhan blogging sabbatical. It’s been a bittersweet month – the economy is chugging along better than I ever hoped for and the German demolition of Brazil in the World Cup semifinals was a hoot to watch, but then there was the staggering blow of the MH17 tragedy and the incomprehensible Israeli invasion of the Gaza strip on the very same day. Geo-political risks appear to be increasing, while the global economy remains on a fragile footing, the US recovery notwithstanding.

Thursday, June 12, 2014

April 2014 Industrial Production: Steady As She Goes

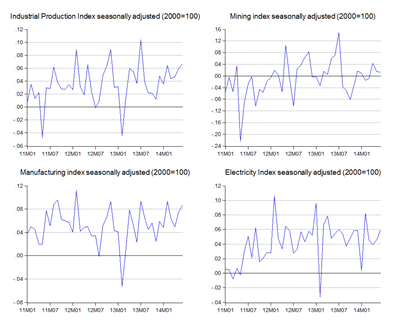

The numbers aren't as spiffy as the out-of-this-world export growth numbers, but they’re pretty respectable (log annual and monthly changes; seasonally adjusted):

Industrial output rose by 4.0%, coming off last month’s 4.3% in log terms, with a pickup in mining helping to offset a pullback in manufacturing and electricity production.

Monday, May 19, 2014

1Q2014 National Accounts

A little stronger than I thought it would turn out to be, but not too much so (log annual and quarterly saar changes; 2005 prices):

Don’t go overboard though – the quarterly growth numbers tell the real tale. 1Q2013 was a really horrible quarter, which means growth for 1Q2014 will flatter to deceive. Note that 1Q growth was stronger in 2011 and 2012, but weaker in the last couple of years (including this past quarter).

Wednesday, May 14, 2014

March 2014 Industrial Production

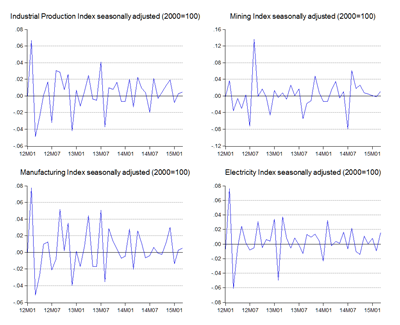

The March numbers that came out on Monday didn’t show a full picture of health, but did confirm that 1Q2014 growth is going to be pretty decent (log annual and monthly changes; seasonally adjusted; 2000=100):

Monday, April 14, 2014

February 2014 Industrial Production

Last week’s IPI numbers gave me a headache – it’s part of another rebasing exercise, this time to 2010, which required a bit of work to splice – but things are looking up (log annual and monthly changes; seasonally adjusted; 2000=100):

Tuesday, February 11, 2014

December 2013 Industrial Production

Yesterday’s IPI report confirms the acceleration in economic growth at the end of last year (log annual and monthly changes; seasonally adjusted):

Friday, January 10, 2014

November 2013 Industrial Production

Yesterday’s industrial production numbers paint a picture of returning growth (log annual and monthly changes; seasonally adjusted):

Friday, December 13, 2013

October 2013 Industrial Production

Industrial output appears to be moderating a little (log annual and monthly changes; seasonally adjusted):

Monday, November 11, 2013

September 2013 Industrial Production

The September numbers aren’t nearly as pretty as the improvement in external trade (log annual and monthly changes; seasonally adjusted; 2000=100):