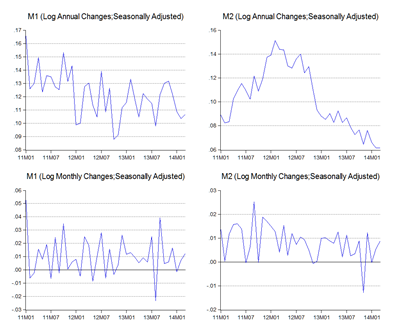

Monetary conditions in March appear to have tightened (log annual and monthly changes; seasonally adjusted):

M2 growth fell to 6.0% yoy, which is more than a little worrying – as a rule of thumb, you want to see money growth approximate real growth plus inflation. Having said that, real indicators have been pretty strong, and loan applications (demand) and especially approvals (supply) look decent; these imply that much of the drop off in money growth is coming from other components of M2.