It's taken me this long to really delve into last week's GDP report, largely because I wanted to try something different (results forthcoming). But before getting into that, the headline numbers themselves are mostly encouraging (log annual and quarterly SAAR changes):

Wednesday, February 16, 2022

Monday, November 13, 2017

Chart of the Week: Don’t Bet On Real Trade Growth

It was a good run, but Malaysia’s trade growth numbers will “normalise” within the next couple of months (RM millions):

However, this is partly a price phenomenon (index numbers; 2010=100):

On the import side, it’s food, fuel, and edible oils and fats; on the export side, fuel and electronics. Import volume, like imports overall, appear to have plateaued, but there’s still some export volume upside, which is still fairly broad-based.

Two conclusions: Despite the steady increase in export volume, I think this runup is at an end – there’s a lot of volatility in the sub-indices, which means that this increase is hiding a lot of movement underneath. The price trends are mostly oil & gas related. Trade volume in the rest of East Asia has also plateaued, so most of the double-digit growth we’re still seeing across the region is simply from the low base last year. That implies growth rates will gradually drop to “normal” levels, which means something in the low single digits again, as the base shifts to the higher numbers seen earlier this year.

Friday, August 11, 2017

Cognitive Dissonance: Singapore Fiscal Policy

I kept getting this promoted tweet on my Twitter feed over the last couple of days, from the Lee Kuan Yew School:

2 principles shape SG's fiscal policy: balancing the budget and keeping government small. #SG52 #SGpublicpolicy https://t.co/VLrH1Sg2Ud pic.twitter.com/mJzJRc0Uny

— Lee Kuan Yew School (@LKYSch) August 8, 2017

I usually don’t bother with promoted tweets, but curiosity eventually won over and I read the article. It’s a fair description of Singapore’s fiscal policy framework, although the part on the management of past reserves could have been expanded for clarity (there’s no mention of GIC or Temasek in there for example, or the endowment funds the government set up).

There is however, one part I’m in violent disagreement with (excerpt; emphasis added):

Wednesday, August 12, 2015

Ringgit Fallacies: Imported Inflation and International Reserves

Another week, another multi-year low for the Ringgit. Since BNM appears to have stopped intervening, the Ringgit has continued to weaken against the USD, to what appears to be everyone’s consternation. There is this feeling that BNM should do something, anything, to halt the slide – cue: rumours over another Ringgit peg and capital controls.

To me, this is all a bit silly. Why should BNM lift a finger? Both economic theory and the empirical evidence is very clear – in the wake of a terms of trade shock, the real exchange rate should depreciate, even if it overshoots. NOT doing so would create a situation where the currency would be fundamentally overvalued, and we would therefore be risking another 1997-98 style crisis. Note the direction of causality here – it isn’t the weakening of the exchange rate that gave rise to the crisis, but rather the avoidance of the adjustment.

Pegging the currency under these circumstances would be spectacularly stupid. I’ll have more to say about this in my next post.

Friday, January 9, 2015

Nov 2014 External Trade

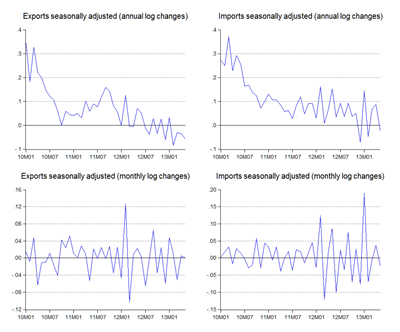

Wednesday’s external trade report seems to defy the gloom that seems to pervade all things Malaysian these days (log annual and monthly changes; seasonally adjusted):

Thursday, August 7, 2014

June 2014 External Trade

Monday, July 7, 2014

May 2014 External Trade: Defying Gravity

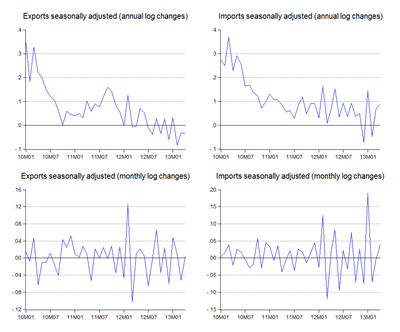

When is the trade engine going to lose steam? I honestly don’t know (log annual and monthly changes; seasonally adjusted):

Tuesday, June 10, 2014

April 2014 External Trade: Up, Up and Away

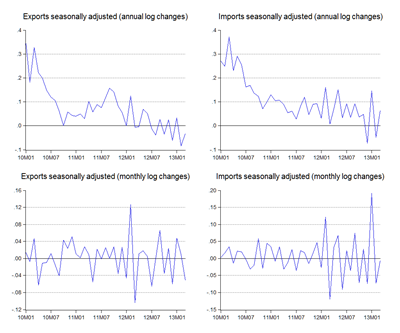

I’m not going to tire of saying this – the first few months of last year were so awful that all the numbers coming in this year look great by comparison (log annual and monthly changes; seasonally adjusted):

To be fair, part of the reason is that we are indeed seeing real growth, it’s just that it’s not as strong as the yearly growth numbers seem to imply.

Thursday, May 8, 2014

March 2014 External Trade

Yesterday’s trade report was a mix of good and bad (log annual and monthly changes; seasonally adjusted):

Export growth was pretty good, at 8.4% in log terms on an annual basis. On a monthly comparison however, exports dropped 4.7%. Import growth was near zero on a yearly basis, and contracted on a monthly basis.

Tuesday, March 25, 2014

February 2014 Consumer Price Index

Question: Has there been an increase in inflationary pressure in the last few months?

Question: Has weakness in the Ringgit contributed to domestic inflation in Malaysia?

I think the answers might surprise a few people, for so far the answer to the first is no (at least, not yet), and the answer to the second is both yes and no.

Let me explain.

Monday, February 10, 2014

December 2013 External Trade

Things are seriously picking up (log annual and monthly changes; seasonally adjusted):

In log terms, seasonally adjusted exports are up 13.9%, while imports rose 13.5%. The monthly growth figures aren’t quite so positive, but the fact that December would be the sixth straight month of expansion says something.

Thursday, January 9, 2014

November 2013 External Trade

If trade growth keeps at this pace, I’d be pretty happy (log annual and monthly changes; seasonally adjusted):

Friday, December 6, 2013

October 2013 External Trade

Recovery on the trade front seems firmly entrenched, based on the latest numbers (log annual and monthly changes; seasonally adjusted):

Friday, November 8, 2013

September 2013 External Trade

The momentum established from August has so far been kept up, which I hadn’t expected. There’s usually a lull after major holidays, so count this one as another pleasant surprise (log annual and monthly changes; seasonally adjusted):

Beating out August’s sharply higher numbers was never on the cards, so a pullback in growth was more or less what I thought might happen. But 4.7% in log terms was more than I hoped for.

Breaking it down:

Electrical and electronics shipments continued to grow, while there was a slight fall back in other exports, largely due to weaker refined petroleum products and metal manufactures. Crude oil jumped by nearly RM1 billion though.

Imports stayed – in my eyes anyway – more or less flat (RM millions):

October’s usually the boom month, where shipments go up to cater for the year end holidays in advanced economies, so if we’re seeing a true recovery in global trade, I’d expect to see even better growth for October.

Technical Notes:

September 2013 External Trade report from MATRADE

Friday, October 4, 2013

August 2013 External Trade

Well, well, well…(log annual and monthly changes; seasonally adjusted):

For what’s seems like the first time in the longest time, the external trade picture looks bullish. Exports climbed 11.7% in log terms for August, while imports 13.6%. Just as significantly, monthly growth stayed positive as well.

Monday, September 9, 2013

July 2013 External Trade

Friday’s trade report was a pleasant surprise (log annual and monthly changes; seasonally adjusted):

[Note: I’m still using my old seasonally adjusted figures, even though DOS now issues there own. I’ll be shifting over to the official figures as and when I manage to find time to transfer the data in. The differences between the adjusted series does not substantively change the following analysis]

Thursday, August 22, 2013

2Q2013 National Accounts

Yesterday’s GDP release showed the Malaysian economy continuing to expand, but well below expectations (log annual changes, 2005=100):

Monday, July 8, 2013

May 2013 External Trade

So much for expecting a bounce. May’s trade numbers offer little room for optimism (log annual and monthly changes; seasonally adjusted):

Monday, June 10, 2013

April 2013 External Trade

April trade data offers little hope for any improvement in external demand (log annual and monthly changes; seasonally adjusted):

Exports have continued to deteriorate, falling 3.4% in log terms in April, but imports have picked up again, rising 8.8% in log terms.

Friday, May 10, 2013

March 2013 External Trade

The growth numbers look pretty bad, but truth be told, exports are just in a holding pattern (log annual and monthly changes; seasonally adjusted):

Exports fell an annual 3,2% in log terms in March, and 5.2% from February. Imports were a little better, expanding 6.4% from last year and shrinking 0.6% from February.